Best Checking Accounts for Bad Credit in 2022 (No Credit Check, No Deposit)

Having a bank account is very important. But, if you have bad credit, it is very difficult to open a new checking account. Some traditional bank checks may refuse to open an account if you have unpaid overdraft fees, late or missed payments, and bad credit due to account closure.

If your credit score is not good enough, you may have difficulty opening a checking account. A bad credit score can also prevent you from opening a bank account.

Checking accounts for bad credit usually comes with a fee. However, there are many banks that do not have a credit check to open an account, which is a great way to improve your credit score. If you have had financial problems in the past, this can help you get back into the business. Below are some banks that do not have a credit check to open an account with the website links.

Top best checking accounts for bad credit:

1. Chime Spending Account

Chime is our biggest choice because it allows you to open a checking account with bad credit and no opening deposit required. Opening a checking account without a credit check usually requires a monthly fee, but with Chime, there is no monthly fee and no overdraft fee. In addition, if you open an optional high yield savings account, you will receive 0.50% APY3.

Chime spending account features

- No monthly or overdraft fees. One bell will see you up to $ 200 on a debit card purchase without an overdraft fee. Eligibility requirements apply.

- Receive payment up to 2 days in advance with direct deposit.

- Transfer money, send and deposit checks and pay bills.

- 60K + fee-free ATMs˜ at Walgreens, 7-Eleven, CVS, and more.

- No monthly or overdraft fees.

- There is no foreign transaction fee.

- Application checks are sent online to recipients.

Optional Chime Credit Builder Visa Credit Card:

- No annual fees or interest.

- No credit check to apply.

- At least a security deposit is not required.

- You must make at least one direct deposit of $ 200 or more into your Chime Spending account before applying for a Chime Credit Builder Card.

- Chime says its credit card users added an average of 30 points to their score, an interest-free credit card with no annual fees.

- Monthly reports on Experian, Equifax, and Transunion.

2. Acorns Checking Account

Acorns Checking Account is the first debit card checking account that saves, invests, and earns for you. The Visa Debit Card is made with an impressive tungsten heavy metal with a matte green finish and your signature engraved as required. Select the option to round up Metal Debit Card purchases and Acorns will automatically invest in additional conversions.

The Acorns Reddit forum talks about the ease of saving money without thinking about it. Acorns’ Earn Money feature connects you to 350+ top brands that deposit money into your Acorns account when making a purchase. Current brands include Walmart, Chevron, Apply, Sam’s Club, Sephora, Kohl’s, Old Navy, Macy’s, and more.

The monthly fee for Acorns is $ 3.00, however, the Earn Money feature usually covers a monthly charge if you make regular purchases with one or more of the 350+ participating brands.

Acorns checking account features

- Get 2 direct deposits of at least $ 250 and a $ 75 bonus will be credited to your Acorns account within 45 days.

- Receive payment up to 2 days in advance with direct deposit.

- There is no overdraft fee.

- Nationwide ATM returns with unlimited free or fee payment.

- Collects purchases made with your debit card and invests in additional conversions.

- The Ear Money feature puts money into your account when you spend on one of Acorns’ 350+ brand name partners.

- Digital direct deposit and mobile check deposit and sending checks.

- Free bank to bank transfer.

- Automatic bill payment.

- FDIC secure checking account up to $ 250,000 plus fraud protection.

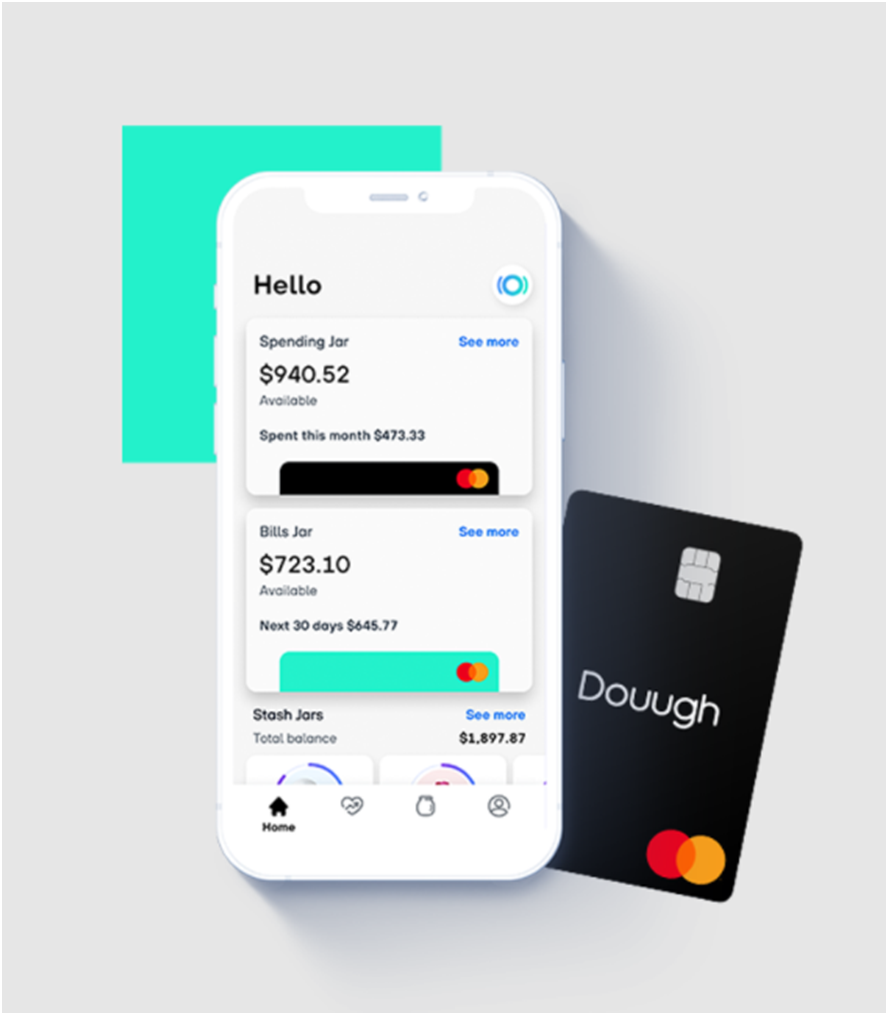

3. Douugh Banking:

Applying for a Douugh Checking Account will not affect your credit score! Just make sure you have your Social Security number in hand. With the Douugh account and the app, you get all the features of a traditional checking account but with many automated budget solutions.

Douugh checking account features:

- No minimum deposit is required.

- Instant Virtual Debit Card Your physical Duff MasterCard will arrive in 7 to 10 days.

- Free withdrawals at over 38,000 ATMs.

- Automated savings jar system that allocates money for bills and savings.

- The monthly service fee is $ 4.99 / month.

- There is no overdraft fee.

- FDIC insured up to $ 250,000 *.

4. OneUnited Bank

OneUnited Bank’s online checking account is available to people in all states. We love OneUnited Bank because customers can add cash to OneUnited Bank debit cards in over 90,000 locations across the country through a partnership with Green Dot.

OneUnited Bank offers a Black Wall Street checking account with no monthly fees. However, if you are not eligible, they offer a U2E checking account that is specifically designed for bad credit.

To get started, go to the “Get Card” button, enter your name, email address, and cell phone number. Select the Black Wall Street Checking Account option with the opening deposit ($ 25.00 minimum), then complete your identification details (name, address, SSN, and employer).

OneUnited Bank Checking Account Features

- The minimum opening deposit is $ 25 (which can be funded by a credit card).

- No monthly fee.

- Get paid up to 2 days in advance with an initial direct deposit.

- Free online and mobile banking.

- Get cash, surcharge-free at over 35,000 ATMs across the country.

- Submit checks via mobile app.

- Free bill payment

- OneUnited also offers a secure credit card that reports to major credit bureaus.

5. Axos Bank

Axos Bank is one of the oldest and most trusted digital banks. This bank offers an instant online checking account for bad credit. It also offers a variety of checking accounts, including a second chance checking account.

Axos Bank Checking Account Features

- Overdraft protection is available.

- Option to open Second Chance Savings Accounts with regular checking accounts.

- It offers bank accounts for bad credit.

- Offers online mobile banking.

6. Betterment check

Betterment offers a hassle-free, free checking account. It is FDIC insured up to 250k and offers attractive cashback rewards. It also offers shared checking accounts. It does not charge overdraft or other account fees. Its investment platform is at the forefront of the industry.

Betterment Checking Account Features

- Betterment visa includes contactless payment, which means you only need your phone to pay.

- Betterment refunds all fees, whether you are using your card abroad or withdrawing cash from an ATM locally.

- If you lose your debit card, you can easily block your card from the app.

- Supports Apple Pay and Google Pay.

- It refunds debit card usage fees at all ATMs.

7. CIT Bank:

CIT Bank is an online bank owned by CIT which is fully digital and offers savings, checking, and loan products. Launched in 2011, CIT Bank offers a wide range of fully online banking products as the bank has no physical space or ATMs of its own, although they provide free access to a nationwide network of ATMs.

Although CIT Bank has a relatively low minimum deposit ($ 100) to get started, it offers the best interest rates among online banks and has no opening, monthly service, online transfer, or upcoming. There is no wire fee.

CIT bank Account Features

- No monthly fee.

- 0.40% APY (if requirements are met)

- Fully online banking

8. Wells Fargo Bank

Wells Fargo offers Clear Access Bank accounts for customers who are unable to open standard accounts due to past credit or banking history. You will not be able to switch to another Wells Fargo account for 365 days before the date of opening your new account. After 365 days have elapsed, you will be eligible to transfer the account to any Wells Fargo checking account currently offered.

Clean Access Banking Features:

- No overdraft or insufficient funds (NSF) fees.

- Papers are not checked

- Bill pay and online transfer

- Mobile deposit

- Debit card with contactless and chip technology

- 24/7 customer service

- Free access to over 13,000 Wells Fargo ATMs

- Budget, cash flow, and spending tools

- Text banking

9. Corporate America Family Credit Union

Corporate America Family Credit Union offers a fresh start checking account that gives you the opportunity to recreate a positive checking account history. You must be a member of the Corporate America Family Credit Union to open a checking account. How to join: Be eligible to become a credit union member through Hope Group.

Fresh start checking account details:

- You must keep at least $ 100 in your regular share account at all times.

- $ 10 monthly fees.

- Bill Pay and Pop Money

- Become a member of the Corporate America Family Credit Union.

- Visa Debit Card

- Get in Balance, a free online study course that empowers you with the tools you need to better manage your checking account.

What is a checking account for bad credit?

Banks offer to check accounts for bad credit because they believe that people often make mistakes with their accounts due to a lack of knowledge.

Many people do not have access to basic financial education, whether at home or at school. Many people open a checking account when they reach a certain age, but no one tells you how to manage a checking account.

You would think that financial literacy would be a compulsory subject in school, but it is not. A report by the Council for Economic Education found that a number of states that require a high school student to take a personal finance course to graduate are integrated into either a sandstone class or other coursework.

It is not uncommon to have both bad credit and ChexSystems records. The two often go hand in hand. One reason is that the bank may report an unpaid negative account balance to ChexSystems through an overdraft, then the bank may later sell the loan to the lending agency. The collecting agency can then report the loan to the credit bureau – causing the credit to deteriorate.

But just as you can recreate credit, banking benefits can be restored through a checking account for bad credit.