Everything about Vance & Huffman

Is Vance & Huffman LLC a scam?

Are you receiving intimidating calls from countless harassers, and even one caller claiming to be a representative of Vance & Huffman and trying to get such a loan? You don’t even remember getting it? This is not a trivial scenario for finding yourself, also known for calling fraudsters and threatening to pay off debts that do not exist.

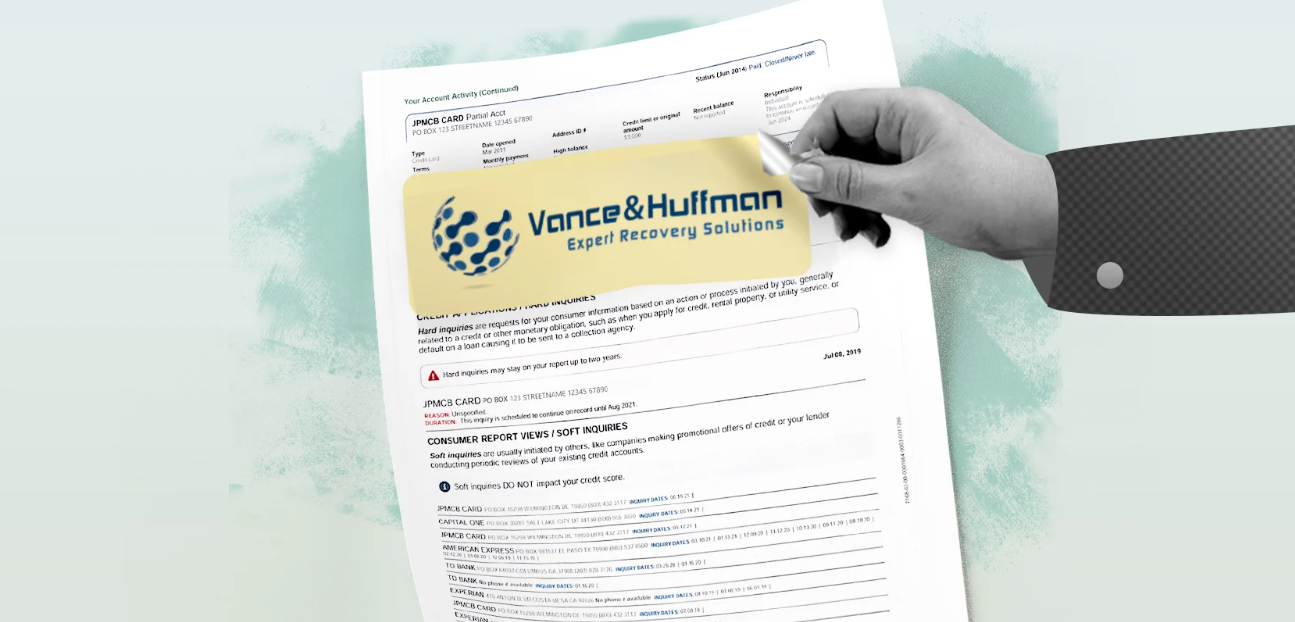

While Vance & Huffman is a legitimate, BBB-approved collection agency licensed in the United States to recover debts owed to consumers, the National Fraud and Cyber Crime Reporting Center (NFCCCRC) Notice the increase in the number of calls to pay off the ghost’s debt. Most of these loans are non-existent, and since the fraudulent collection agency is aware of this (and the fact that it cannot provide valuable evidence to support its claim), they are often violent and immoral. Debt Consolidation Loans – Getting a Debt Consolidation Loan, Even With Poor Credit

Regardless of whether the debt collection agency approaches you for a non-performing loan, it is illegal to harass a debt collector in the United States under laws such as the FDCPA and TCPA. If you believe that Vance & Huffman has in any way violated your FDCPA rights, you may be entitled to legal damages of up to $ 1000. Similarly, if they violate your TCPA rights, you may be entitled to legal damages of $ 500 and $ 1500 if you can prove that it was a deliberate violation.

What do we know about Vance & Huffman LLC?

No legal action has been taken against him and no case has been registered against him. We do not currently have an open case against Vance & Huffman LLC for FDCPA violations.

If you – or someone you know owns Vance & Huffman LLC, or any other collection agency, your consumer rights are being violated, let the collector sue to help you!

Take a moment to complete our free consultation survey at the bottom of this page! Our expert legal team will review your information and help you determine if you have a lawsuit against your debt collector; you will not be charged!

Vance and Huffman Complaints

The Fair Debt Collection Practices Act (FDCPA) is a federal law that applies to everyone in the United States. In other words, everyone is protected under the FDCPA, and the Act Laundry List lists what debt collectors can and cannot do during debt collection, as well as the things they can do to collect debt. Have to do If Vance & Huffman is bothering you for a loan, you have rights under the FDCPA.

The Telephone Consumer Protection Act (TCPA) protects you from robot calls, which are annoying, automated, recorded calls that computers make throughout the day. You could say this is a robo call because either no one at the other end of the line answers, or your phone picks up late before a living person can answer. If Vance & Huffman violates the TCPA, you may receive $ 500 per call. Have you received a message from this agency that seems pre-recorded or cut-off at the beginning or end? These are signs that the message has already been recorded, and if you have these messages on your cell phone, you may have a TCPA case against the agency.

The Electronic Funds Transfer Act (EFTA) protects electronic payments deducted from bank accounts. If Vance & Huffman has made unauthorized deductions from your bank account, you can make an EFTA claim against the agency. Vance & Huffman, like most collection agencies, want to set up recurring payments from customers. Imagine how much money hundreds, even thousands, of consumers could earn if they electronically paid them $ 50- $ 100 or more per month.

If you agree to this type of refund, the agency must take specific steps to comply with the EFTA. Has Vance & Huffman continued to make electronic payments despite your request to stop? Did they take more money from your checking account than you agreed? If so, we may discuss your rights and a possible case under the EFTA.

The Fair Credit Reporting Act (FCRA) works to ensure that no information in your credit report is incorrect. In essence, it gives you the right to argue about the mistakes you make in your credit report. We’ve dealt with a number of cases where the debt collection agency reported the loan on the consumer’s credit report to benefit the consumer. If Vance & Huffman is on your credit report, they can tell you that if you pay it, they will remove the debt from your credit report. This is commonly known as “payment for deletion”. If the actual creditor is on your report, rather than the creditor, and you repay the loan, both institutions must accurately report this on your credit report.

Many states also have laws to provide their citizens with an extra layer of protection. For example, if you live in California, Florida, Michigan, Montana, North Carolina, Pennsylvania, Texas, or Wisconsin, you can add a state law claim to your federal law claim. For example, North Carolina has one of the most user-friendly laws in the country: If you live in NC and you are harassed because of debt, you will be fined $ 500 , $ 4,000 per violation. We work with a local lawyer in NC and our NC clients have had excellent results in debt collection harassment cases. If you live in North Carolina and are being harassed by debt collectors, you have the advantage of getting a great settlement.

What if Vance & Huffman is on my credit report?

Based on our experience, some debt collectors may report credit, which means that someone can mark your credit report with the debt they are trying to collect. In addition to or instead of the debt collector, the actual lender may be on a separate entry on your credit report, and it is important to identify these institutions correctly as you will both want your credit report Update if you pay.

The good news is:

If Vance & Huffman is on your credit report, we can help you dispute it. Mistakes in your credit report can be very costly: in addition to paying you high interest rates, you may also be denied credit, insurance, rental, loan, or job due to these mistakes. ۔ Some errors may include someone else’s information on your credit report, incorrect public records, stale deposit accounts, or identity theft. If there is an error in your credit report, it is a matter of dispute, and my office will assist you in obtaining your credit report and disputing any misinformation.

Remember…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to legal damages of up to $ 1,000, and the credit reporting agency will need to correct the error. The FCRA also manages fee shifts, which means that the credit reporting agency will pay your attorney’s fees and expenses. You will not owe us a single penny for our services. We’ve helped hundreds of users correct inaccurate information on their credit reports, and we’re ready to help.

How do I remove Vance and Huffman from my credit report?

Aggregates can damage your credit score and can last up to seven years on your credit report whether you pay it or not. Unfortunately, paying a deposit can also lower your credit score.

However, it is possible to delete a collection account from your credit history before seven years.

How To Protect Yourself From Debt Collection Scams

- Investigate: If the caller claims that you are being prosecuted, they should be able to provide a warrant and case number with contact details for the court they are calling. It can be used as a reference.

- If the caller claims to be a court or law enforcement official, they should be able to identify themselves with their ID card, which includes their number and photo.

- Be sure to verify with your employer before agreeing to repay a loan for the business you work for. Fraudsters may tell you that you will be paid by your employer when the debt does not actually exist.

- Fraudsters can forge online profiles so you can trust them. Don’t believe that the organization they claim to represent is real because they have an online presence. Be sure to check them out on other recognized platforms, such as Better Business Bureau.

- If your original debt collector has not notified you that your debt has been transferred to a third party, call your original creditor to verify the recovery agency’s claim.

- Don’t be pressured to make a tough decision based on a phone call.

(Debt collectors prefer that we do not tell you, but this is something you should know.)