How Different Types of Credit Can Boost Your Credit Score

How can different types of credit affect your credit scores?

A credit score is an important number for anyone who intends to apply for a credit card or loan. It is also easy to verify that you are making the right decisions with the use of your credit. Since banks set approvals and pricing on credit scores, it is in your best interest to get the best credit score. This means taking advantage of every factor that will help you increase your score, such as using different types of credits.

One of the five most important factors in your credit score is your credit mix. This factor accounts for 10% of your FICO credit score. This section considers how much experience you have with different types of credit accounts. Your credit score reflects how you manage different types of credit.

Different types of credit that you can get:

Credit scoring does not specify the specific number of points you can earn by adding different types of credits. A new account will affect each person’s credit score differently, depending on other information in their credit report.

Collection accounts are another type of account that may appear on your credit report, but it is best if you have no deposit experience as they can damage your credit score.

Experience with a variety of credit shows allows you to handle a variety of credit obligations. Being able to manage a mortgage is a very different kind of responsibility than managing a credit card or even an auto loan. The FICO score also applies to people who have no experience with credit cards and are risky borrowers. If you have only installment loans on your credit report, adding a credit card can help boost your credit score.

Warning about opening new accounts

You should not open new accounts just to try to increase your credit score with a mix of credits. Instead, add accounts as you need them over time and your credit score will naturally increase.

For example, it is not a good idea to take out a mortgage for the sole purpose of adding a real estate account to your credit score. Instead, you should buy a home when you are financially ready. In addition, having a positive mortgage history can help your credit score in the long run, but many borrowers experience a decline in credit score in the first several months after taking out a mortgage.

Adding debt too early can lead to major debt problems. Taking too many accounts at one time can make it difficult to keep up with all your payments. You can extend the limit and damage your credit by losing payments.

Each time you apply for a new credit, an inquiry is made into your credit report to determine if you are eligible. These queries count for 10% of your credit score and can cost you a few credit score points.

Can a poor credit mix hurt your credit score?

Your experience with different types of credit is only a small part of your credit score. The combination of credit accounts is only 10% of your total FICO score. However, it can cause a 10% effect and play a big role when you do not have much information on your credit report.

A few other factors play a significant role in your FICO credit score. The payment date is 35% of your credit score. Your loan amount is 30% and the length of your credit history is 15%.

VantageScore, another credit score that some lenders use, combines a blend of credit with the term of credit and the percentage of credit used.

Not having a credit mix doesn’t mean you have to have bad credit. As long as you pay your existing accounts on time, your credit score will improve because you will have a solid payment date. However, you may not be able to get a credit score of 800 or higher unless you have multiple types of credits on your credit report.

Even so, you can still qualify for a competitive interest rate with a credit score above 670 and excellent rates above 740.

No matter what type of credit you have, the best way to increase your credit score is to make your monthly payments on time and not overdo it with debt.

6 Reasons Why Your Credit Score Is Different

- Credit Scoring Model Used: There are several models for scoring your credit history. But in general, lenders use one of the two main credit scoring models FICO or VantageScore. Both companies review equally important factors of your credit history such as payment history and usage rate but use their own formulas to weigh each factor.

- Score versions: There are dozens of versions of credit scores that are divided into basic scores and industry-specific scores. Basic scores, such as FICO® Score 8 or VantageScore 3.0, indicate to lenders the likelihood that you will pay off any credit obligations. Industry-specific scores represent the odds that you will have to repay a specific loan, such as the FICO® Auto Score 9 used in auto loan decisions.

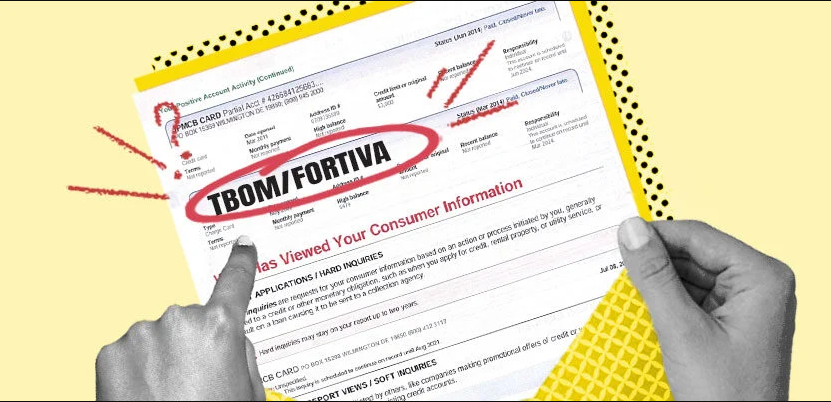

- Credit Bureau: Credit scores are calculated using the data on your credit report, which comes from one of the three major credit bureaus: Experian, Equifax, or TransUnion. Your score varies depending on the information provided to each bureau, further explained.

- Information provided to credit bureaus: Credit bureaus may not have all the same information about your credit accounts. Surprisingly, lenders do not have to report to all or any of the three bureaus. While most do, there is no guarantee that the information will be consistent across the board, which could potentially make a difference in your score.

- Access to a history score: If you look at your credit score at different times, there may be discrepancies because one score may be out of date.

- Mistakes in your credit report: Your credit score can reflect any error that appears in your credit report. If errors only appear on one bureau’s report, your credit score may differ from one report to another without any errors. To avoid damaging your credit score, you should dispute the errors in your credit report.