Average Credit Score in USA

What Is the Average Credit Score in the U.S.?

Economic conditions can vary widely across states. It is difficult to get a complete picture of a given area without considering all the important factors. In terms of credit scores, knowing the average can help residents of the state see how they compare to their neighbors and for those considering moving to the state to learn more about How will they fit financially? It can also be a factor in estimating business opportunities within the state.

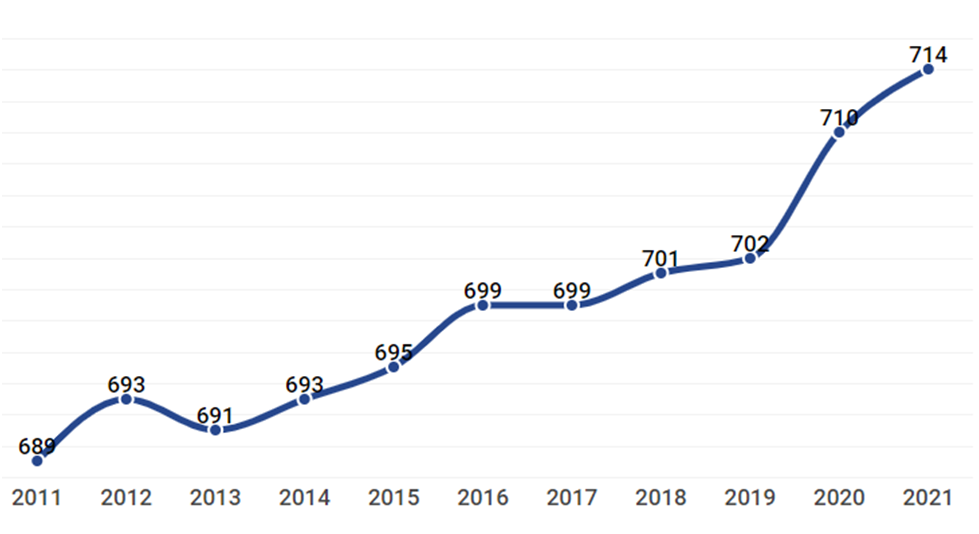

Average Credit Score in the U.S. Reaches a Record High—Again

Across the country, the average FICO® score jumped from four points to 714, for the fourth consecutive year. A credit score of 700 or higher is generally considered good.

Increased average FICO® score between all races.

Scores increased in all age groups. And for the first time, Generation X’s average FICO® score (ages 41 to 56 in 2021) is in the 700’s.

From 2020 to 2021, the average score of both Millennials and Generation X increased by seven points. The youngest users in Generation Z added five points to the score, and the Baby Boomers’ average score increased by four points. Silent race – the group with the best average credit score – increased by two points.

| Average FICO® Score by Generation | ||

| Generation | 2020 | 2021 |

| Silent generation (76+) | 758 | 760 |

| Baby boomers (57-75) | 736 | 740 |

| Generation X (41-56) | 698 | 705 |

| Millennials (25-40) | 679 | 686 |

| Generation Z (18-24) | 674 | 679 |

Credit card usage does not change in practice. Crime rates remain low

Credit usage, or credit usage, is the amount of revolving credit you are currently using divided by the total credit available to you. In 2021, the average credit card usage rate was 25.3%, which is virtually unchanged from the 2020 rate of 25.2%. Currently, according to the Federal Reserve, large banks show no signs of tightening standards on credit card loans, and consumer spending remains strong despite consumer frustration with the economy.

| Average Overall Credit Utilization Ratio | |

| 2020 | 2021 |

| 25.2% | 25.3% |

Similarly, consumers do not appear to be lagging behind in credit card payments at high rates. Nationwide, 1.67% of all credit card accounts are in some form of crime, down from 1.82% in 2020.

| Percent of Credit Card Accounts Considered Delinquent | |

| 2020 | 2021 |

| 1.82% | 1.67% |

The average FICO® score increased in all the states.

The FICO® score averaged at least two points in all 50 states, with Washington, D.C., Mississippi, and Nevada experiencing the most increases, with each state averaging more than six points. Minnesota remains the state with the highest average credit score of 742, a three-point improvement since 2020. Vermont has the second-highest average of 736, and Wisconsin has the third-highest average credit score of 735.

Despite the various financial difficulties faced by consumers during epidemics, the average credit score increased in both 2020 and 2021. Clearly, many consumers have found a way to keep their payments on time; potentially increasing revenue, using stimulus payments, or taking advantage of mortgage and loan deferment programs for student loans, Which can be a big part of the household budget.

Other common triggers for rising crime, such as lower incomes and lower house prices, were not experienced during the Great Depression. In fact, in 2021 there was an unusually large increase in house prices and a significant shortage of labor in many industries which contributed to the increase in wages.

| Average FICO® Score by State | ||

| State | Average Credit Score, 2020 | Average Credit Score, 2021 |

| Alabama | 686 | 691 |

| Alaska | 714 | 717 |

| Arizona | 706 | 710 |

| Arkansas | 690 | 694 |

| California | 716 | 721 |

| Colorado | 725 | 728 |

| Connecticut | 723 | 728 |

| Delaware | 710 | 714 |

| District of Columbia | 713 | 717 |

| Florida | 701 | 706 |

| Georgia | 689 | 693 |

| Hawaii | 727 | 732 |

| Idaho | 720 | 725 |

| Illinois | 716 | 719 |

| Indiana | 707 | 712 |

| Iowa | 726 | 729 |

| Kansas | 717 | 721 |

| Kentucky | 698 | 702 |

| Louisiana | 684 | 689 |

| Maine | 721 | 727 |

| Maryland | 712 | 716 |

| Massachusetts | 729 | 732 |

| Michigan | 714 | 719 |

| Minnesota | 739 | 742 |

| Mississippi | 675 | 681 |

| Missouri | 707 | 711 |

| Montana | 726 | 730 |

| Nebraska | 728 | 731 |

| Nevada | 695 | 701 |

| New Hampshire | 729 | 734 |

| New Jersey | 721 | 725 |

| New Mexico | 694 | 699 |

| New York | 718 | 722 |

| North Carolina | 703 | 707 |

| North Dakota | 730 | 733 |

| Ohio | 711 | 715 |

| Oklahoma | 690 | 692 |

| Oregon | 727 | 731 |

| Pennsylvania | 720 | 723 |

| Rhode Island | 719 | 723 |

| South Carolina | 689 | 693 |

| South Dakota | 731 | 733 |

| Tennessee | 697 | 701 |

| Texas | 688 | 692 |

| Utah | 723 | 727 |

| Vermont | 731 | 736 |

| Virginia | 717 | 721 |

| Washington | 730 | 734 |

| West Virginia | 695 | 699 |

| Wisconsin | 732 | 735 |

| Wyoming | 719 | 722 |

How To Improve Your Credit Score

It may be helpful to improve your FICO® score before applying for a new line of credit, such as a credit card, mortgage, or personal loan. A higher score can help you secure better terms and lower interest rates available. Here are some steps you can take to improve your FICO® score:

- Pay all your bills on time. This will help ensure that your repayment date will be spotless and will show creditors that you have a history of handling credit responsibly.

- Pay credit card balance. Keeping your credit card balance low will help keep your credit balance in check.

- Apply for credit only when you really need it. Credit applications usually result in a rigorous inquiry into your credit report. This can have a short-term negative effect on your credit score and can increase if you make repeated credit requests. Taking on too many new credits also shortens the average age of your credit accounts, which can affect your score.

Understanding your credit profile can help you understand what lenders see when they look at your credit report. Getting your free credit score and report from Experian can show you where you are and what steps you can take to improve your score.

What is the difference between the FICO score and VantageScore?

FICO is a leading analytics company. VantageScore is a collaboration between the three CRAs to provide consistency for a higher credit score.

FICO scores consider five categories from your credit reports:

- Payment Date: 35%

- Amount due: 30%

- Length of your credit history: 15%

- New credit accounts: 10%

- Composition of credits used: 10%

VantageScore models use similar categories but categorize by influence:

- Payment date: Very effective

- Use of Credit: Highly Influential

- Your Credit History and the Length of Your Credit Mix: Highly Influential

- The amount owed: Affects moderation

- Recent Credit Behavior: Less Influential

- Credits available: Less influential

What is a good credit score?

Credit scores can generally be grouped as follows:

- 800 and Above: Best

- 740 to 799: Very good

- 670 to 739: Good

- 580 to 669: Fair

- 579 and below: poor

Just remember that everyone’s financial situation is unique. There is no magic number that will guarantee you better loan rates and terms.