How credit Score is Calculated?

Credit scores are so important to people’s financial lives that it’s natural to wonder: How is my credit score calculated?

Credit Score, also often referred to as FICO Score, is a proprietary tool developed by FICO, a data analytics company formerly known as Fair Isaac Corporation. The FICO is not the only credit score available, but it is one of the most common measures that lenders use to determine the risk involved in doing business with a borrower.

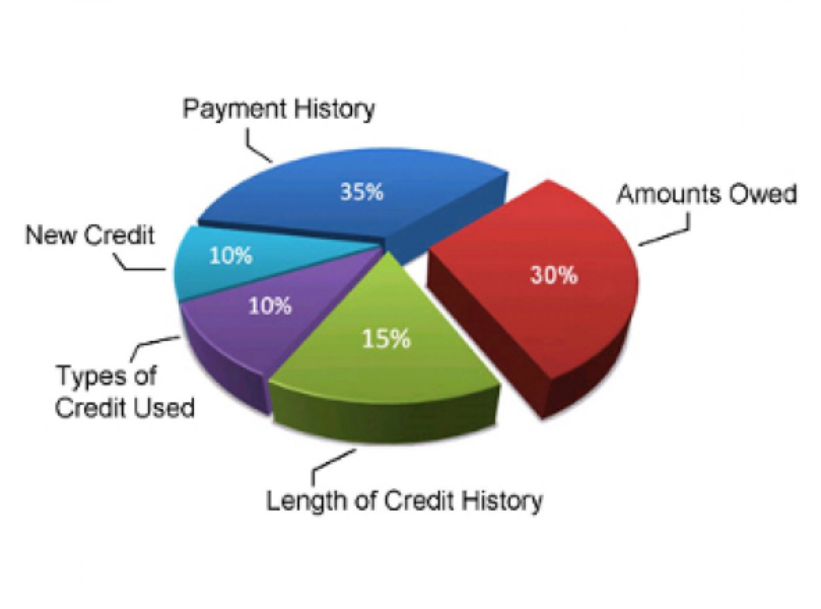

In general, here are the factors that are considered in the calculation of credit scoring. Depending on the scoring model used, the weight of each factor affecting the credit score may vary.

- Number of your accounts

- Types of Accounts

- Your Used Credit vs. Your Available Credit

- Length of your credit history

- Your payment date

One of the common drawbacks of the factors that credit scoring models consider is this, keeping in mind that there are many different credit scoring models.

Payment date

When a lender or lender looks at your credit report, one important question they are trying to answer is, “If I extend this person’s credit, will they repay it on time?” Will you? ” One of the things they will consider is your payment history – how you have paid off your credit in the past. Your payment history may include credit cards, retail department store accounts, installment loans, auto loans, student loans, finance company accounts, home equity loans, and mortgage loans.

The payment history will also show lender or lender details on late or missed payments, bankruptcy, and collection information. Credit scoring models typically look at how late your payments were, how much was owed, and more recently and how often you missed out on payments. Your credit history will also tell you how many of your credit accounts have failed in relation to all the accounts in the file. Therefore, if you have 10 credit accounts, and you have made late payments on 5 of those accounts, this ratio can affect credit scores.

Your payment history also includes bankruptcy, foreclosures, wage attachments, and details of any accounts that have been reported to the collecting agencies.

In general, credit scoring models will consider all of this information, which is why the payment history section can have a big impact on determining certain credit scores.

Used Credits vs. Available Credits

Another factor that lenders and lenders are looking at is how much of your available credit “credit limit” you are using. Lenders and lenders like to see that you are able to use credit responsibly and repay it regularly. If you have a mix of credit accounts that are at or above the “maximum”, this can affect credit scores.

Type of credit used

Credit score calculators can also consider the different types of credit accounts you have, including revolving loans (such as credit cards) and installment loans (such as mortgages, home equity loans, auto loans, student loans, and personal loans).

The second factor is how many accounts you have of each type. Lenders and lenders want to see that you are able to manage multiple different types of accounts, and the credit scoring model can reflect this.

New credit

Credit score calculation can also take into account how many new credit accounts you have recently opened. New accounts can affect the length of your credit history.

Length of credit history

This section of your credit history describes how long different credit accounts have been active. Both credit score calculators can consider how long your oldest and most recent accounts have been open. Generally, lenders like to see that you have a history of paying off your credit accounts responsibly.

Hard Inquiries

“Hard inquiries” occur when lenders and lenders check your credit in response to a credit request. A large number of difficult inquiries can affect your credit score. However, if you are shopping for a new auto or mortgage loan or a new utility provider, multiple inquiries are usually treated as a fixed-term inquiry. The time period may vary depending on the credit scoring model, but it is usually 14 to 45 days.

Credit score calculations do not take into account requests made by the lender for your credit report for a pre-approved credit offer, or periodic review of your credit report by lenders and lenders. With your current account. Credit scores are not affected by checking your credit. They are known as “soft inquiries”.

What’s not included?

It is important to understand that your credit score only reflects the information contained in your credit report. Your lender may consider other information in its assessment.

However, your credit score is a key tool used by lending agencies. It is important that you keep an eye on your credit report. This is the basis of your credit score, so it is important to review it at least once a year and correct any errors in it. In addition, if you find that your credit score is low and you need help removing any negative marks, there are credit repair companies that can help.