Sign that you shouldn’t get a credit card

Despite the many benefits they have gained over the years, credit cards really do offer benefits that you can’t get from other forms of payment. While most come with zero fraud liability, others come with guaranteed returns, rental car insurance, trip cancellation/interruption insurance, and extended warranty. Credit cards with the best rewards on the market also offer airline mails, hotel loyalty points, fixed travel credit, or cash back for every dollar you spend. And yes, all of these benefits can be “free” with the important caveat that you avoid the plague of credit card interest.

On the other hand, when you pay with cash or debit card, you will not get any of these benefits. With that in mind, it’s no surprise that so many people are turning to credit cards.

Unfortunately, this is where the love story ends. Yes, a lot of Americans use credit cards. And yes, we owe it to ourselves to show it. As of October 2016, Americans have a combined debt of 1 981 billion in credit card debt, according to the Federal Reserve. The average unpaid balance as of May 2016 was 9,600, according to CreditCard.com, among households with credit card debt.

Top reasons:

1. You already have a lot of debt.

For the first time in history, student loan debt has surpassed credit card debt ($ 1.56 trillion in Q4 2020). Recent graduates drop out of college with tens of thousands of dollars in debt. With monthly debt payments, there is no point in taking more monthly bills for many of these graduates. Similarly, mortgage or auto loan borrowers may decide to give up credit cards unless they reduce their existing debt obligations.

2. You think you can spend more.

People with bad spending habits risk getting into financial trouble by getting credit cards. Studies show that people spend more on credit card swipes than they do on cash purchases. If you already know that you have a tendency to spend more, then it is wiser to move to a credit card than to lure yourself into debt.

3. You cannot pay the full balance every month

If you only work part-time, part-time, or not at all, you may not have enough money to pay off your credit card balance each month. Getting a credit card when you don’t have enough money to pay the bills will add interest every month and increase the risk to your credit.

4. You don’t understand how credit works.

When you have no experience with credit cards, you will find that using one is much easier than understanding interest rates.

Don’t be fooled by the simplicity of swiping Attached to each credit card are user agreements and hidden fee pages. Thankfully, there is a lot of information on the Internet that can break down the way credit cards work and how to use them wisely. Once you understand how interest is calculated, and what fees will be charged to you, you will be in a much better position to use your credit card responsibly.

5. Now you can barely afford the bills you have.

If you earn enough money to qualify for a credit card, but you already have a lot of bills, it is not a good idea to include credit cards in your current obligations. Work on eliminating some of your bills and reducing your expenses before adding credit cards to the mix.

6. You are not financially disciplined.

It takes patience and restraint to use credit wisely. Without these skills, you can easily spend yourself on debt, interest, and poor credit. If you feel you are unable to control your expenses, then the decision to transfer credit cards is the best choice for your financial future.

7. You don’t want to pay interest on your purchases

By paying your balance in full each month, you can use the credit without paying interest. You need more than luck to succeed in affiliate business. You need more than luck to succeed in affiliate business. You need JavaScript enabled to view it. Even if you plan to repay your balance in full each month, there will always be variables that put you at risk of not doing so. Without a credit card, you never run the risk of paying interest, charging late fees, or damaging your credit score.

Credit card opening alternatives

Depending on your situation, there are other ways to meet your needs without having to resort to a credit card. Here are some examples:

- Take another look at your budget. If you are considering a credit card because your budget is tight, take another look at your expenses to see if you can cut back on certain areas or make more money.

- Take out a personal loan. If you are thinking of using a credit card to help consolidate your debt or pay off major expenses, you may be able to get better terms with a personal loan. On average, personal loans charge lower interest rates, and if your credit is good or in good shape, you can save a single-digit rate. You can use personal loans for anything, including debt consolidation.

- Open a checking account with debit card rewards. If you are thinking of a credit card because you want to get rewards, there are many debit card rewards programs that offer cashback on every purchase you make or bonus rewards with certain merchants. You can also take advantage of cashback websites like Rakuten and Topcashback.

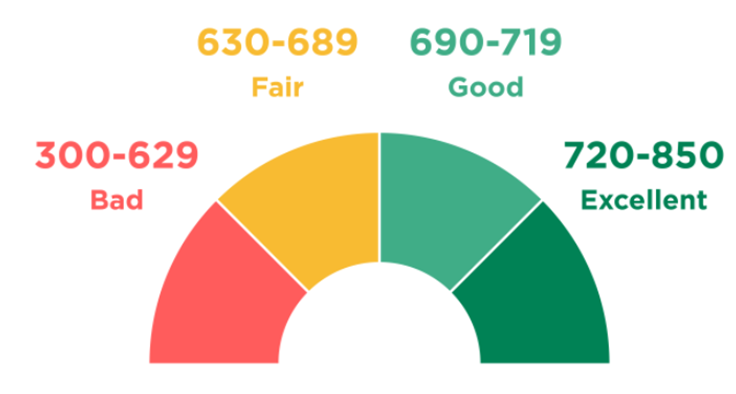

Whether you decide to apply for a credit card right now or you want to wait, prefer to monitor your credit regularly. Keeping a finger on the pulse of your credit history can help you solve problems that are holding you back and take steps to improve your credit over time.

Bottom line

It can be difficult to survive without a credit card at a time when electronic payments are being made, but there are alternatives. You can use a debit card (linked to your checking account) in almost every transaction where you would otherwise use a credit card. A prepaid debit card, like a debit card but without a linked checking account, is another option, but beware of the associated fees.

With debit and prepaid cards, it can be more difficult to rent a car or reserve a hotel. You may have to pay a higher security deposit or provide additional documentation. Check with the merchant prior to your reservation to determine what is required based on your payment method.