Credit score affected by personal loan

How Do Personal Loans Affect Your Credit Score?

Getting a personal loan can be a great way to accomplish two goals at once: get the money you need for a big purchase, and build your credit score. This can help you in the future if you want to open a rewards credit card or borrow more money, such as a mortgage to buy a home.

The weird thing about using personal loans to build credit is that it affects your credit score in different ways, both good and bad. If you make all your payments on time, the net effect is usually positive. Even so, owning one is still beyond the reach of the average person.

What is a personal loan?

Unlike auto or home mortgage loans, which are designed for specific purposes, personal loans are consumer loans that can be used for anything you want. For example, you can take out a personal loan to start a new business, pay your medical bills, or finance an expensive but urgent home repair (such as a new roof in the middle of the rainy season).

Because personal loans generally have lower interest rates than credit cards, many people use them to pay off credit card loans or other high-interest loans. (These loans are sometimes advertised as debt consolidation loans.) However, since personal loans are unsecured ie you do not need any collateral for them, their interest rate secured loans like auto More than a loan or home mortgage.

You can get a personal loan from a bank, credit union, or online lender. The loan terms you are eligible for will vary depending on your credit score, the amount you are looking for, and other factors. As long as you have a good credit score, you can get approval for a personal loan within days. Find out what else you need to know before applying for a personal loan.

What are the factors in your credit score?

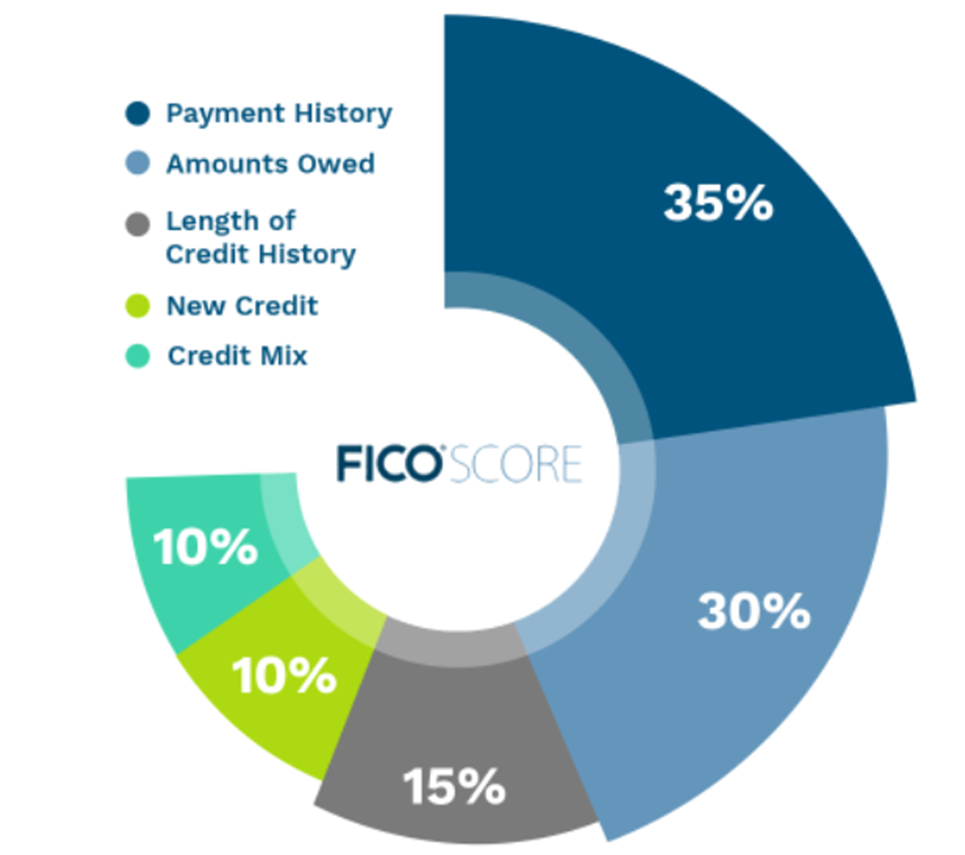

To understand how taking a personal loan affects your credit score, you need to know how the score is calculated. The most widely used credit score by creditors is FICO, developed by Fair Isaac Corporation. FICO scores are between 300 and 850.

Scores are calculated based on five factors: payment date, the amount owed, length of credit history, new credit, and credit mix. The exact percentage may vary between the three major credit rating agencies, but according to FICO, here is a summary of how much each factor weighs in the calculation:

- 35% is based on your payment history.

- 30% is based on the total amount of your outstanding debt.

- 15% is based on the length of your credit history.

- 10% is based on any new loan or new open lines of credit.

- The 10% credit mix is based on the number of credit lines you have opened (including secured credit cards).

Does Applying for a Loan Affect Your Credit Score?

As you can see, getting a new personal loan can affect your credit rating. Your outstanding debt has increased, and you have acquired a new loan.

Credit agencies note new financial activities. If, for example, you tried to arrange a new car loan immediately after taking out a personal loan, your application for a car loan may be rejected on the grounds that you already have as much debt as you can handle.

Your overall credit history has a greater impact on your credit score than a new loan. If you have a long history of debt management and timely repayment, a new loan is likely to reduce the impact on your credit score. The easiest and best way to prevent personal debt from lowering your credit score is to make your payments on time and within the terms of a loan agreement.

How Personal Debt Can Increase Your Credit Score

A personal loan that you repay on time can have a positive effect on your credit score, as it shows that you can handle the debt responsibly.

Conversely, those who are most opposed to borrowing may have lower credit scores. The person who never gets a loan and repays it in installments has no repayment date.

What credit score is required for a personal loan?

As mentioned earlier, credit scores are between 300 and 850. The higher your credit score, the more likely it is that a lender will approve your loan application and offer more favorable terms, such as lower interest rates. While each has its own criteria, lenders generally view scores above 670 as an indication that the borrower is trustworthy.

FICO scores fall into five categories: poor, fair, good, very good, and extraordinary. Here is the limit error:

- Poor (<580): below average and lenders will consider you a risky borrower.

- Fair (580-669): below average, but many lenders can still approve loans with this score

- Good (670-739): Close to or slightly above average and most lenders consider it a good score.

- Very good (740-799): Above average and shows lenders that you are a very reliable borrower

- Extraordinary (800+): Above average and lenders will see you as an extraordinary borrower.

When to consider a personal loan?

Now that you know the pros and cons of personal loans, when does it make sense to apply for them? Here are some situations where a personal loan maybe your best option.

- You have to repay the loan at a higher interest rate. Because they have lower interest rates than credit cards, personal loans can help you get out of a credit card debt at a lower cost.

- You have an expensive emergency. Sure, you can put this new ceiling on a credit card but then you are taking out a higher interest rate loan which will increase over time. When a costly emergency arises, it can be a great way to get a personal loan with low-interest rates and fixed payments.

- You want to rebuild your home. Unlike the Home Equity Line of Credit (HELOC), your home does not need to be used as collateral for personal loans. It allows you to finance your home without compromising it.

Some people take out personal loans for weddings, holidays, and other big celebrations. Whether or not this makes sense to you depends on your personal finances. If you know that you will have money to pay off a debt every month, then a personal loan may be the answer you are looking for. But if you are already living on a tight budget, getting a personal loan to finance a trip to Fiji can get you into trouble. If you can’t pay, your credit score will suffer. Instead, start saving for your dream trip instead of paying extra interest.