Get prepare your credit for your next purchase

Ways to Prepare Your Credit For Your Next Big Purchase

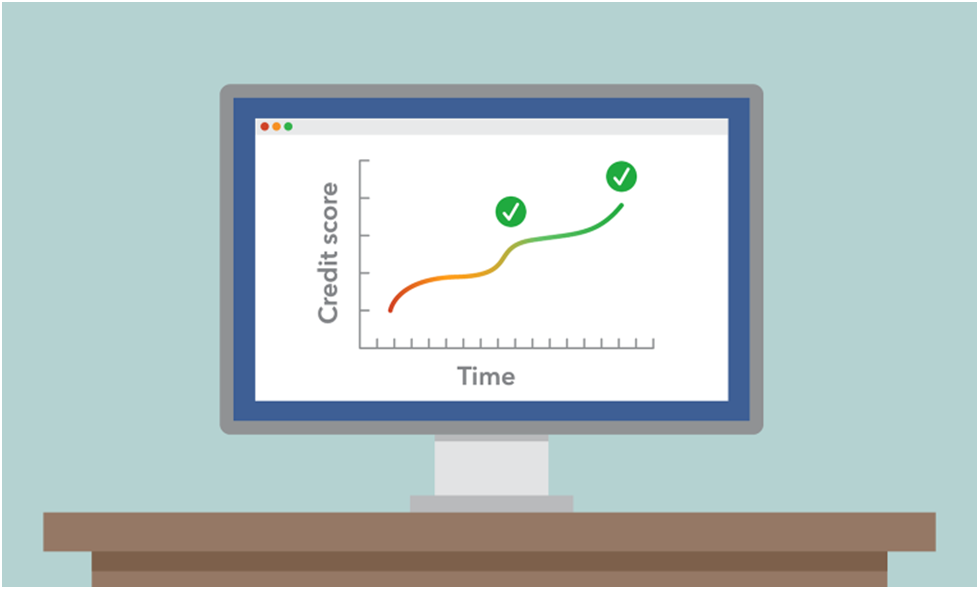

Most people at some point in their life experience a big purchase like a car or a house. On top of that, most will also have financing for these purchases. While you may be approved, if you have a low credit score you do not have to proceed with the loan as you may be given a higher loan rate. The total cost, or finance charges, could have been much lower if credit had been prepared in advance. Today, we discuss some of the steps that should be taken weeks and months before these big purchases.

1. See your financial picture

Start by considering what you can afford in view of your current income, expenses, and other debt obligations. Estimate how much money comes into your home each month, and where the money goes. Be sure to consider your net income – what is available to you after tax.

For home buyers: When buying a home, a general rule is to spend about 30% of your gross monthly income on housing (in big cities, this could be around 40% or even 50%). This includes principal and interest on the mortgage, property tax, insurance, and maintenance costs.

For car payments: A general rule is to keep the total monthly expenses of the car at about 20% of the monthly salary for taking home.

2. Check and report your credit score.

It is important to check your credit score and report when considering a large purchase such as a home or car.

Pull out your credit report from AnnualCreditReport.com and follow the additional instructions to see your current credit score – which affects the total cost of financing your purchase. The lower your credit score, the more likely you are to have higher interest rates and higher overall costs.

Tip: Make sure your report is accurate. Correcting mistakes or misinformation often helps boost your credit score, giving you more attractive financing options. If the report is incorrect, file a dispute with the credit bureau.

Be sure to check out all three bureaus, Experian, Equifax, and TransUnion, because sometimes one has information that the other does not. Before making a major purchase, thoroughly examine your financial options (and make sure you understand).

3. Investigate your financial options.

When buying a home, this means giving yourself plenty of time to explore the mortgage options including the types of mortgages, terms, fees, interest rates, and other information. Consider getting a pre-approval or pre-qualification letter from a lender, especially in a competitive market with a low housing inventory.

If you are seeking financing for a car or other major purchase, stop many dealerships or online offers that will try to get you financing but maybe lower rates than your credit union. Don’t offer interest.

4. Plan your purchase

Timing is everything, and having a plan for when to pull the trigger can make all the difference. Do you have enough savings to make a good down payment on your home or car? Is there a special time of year when special funding or promotions are generally available? The three-day weekend is notorious for clearing sales and inventory.

This is also a good time to find someone you trust. If you are buying a home, ask your friends or family for a real estate agent to help you make a big purchase. They can cite.

Having someone in your corner as one of our trusted real estate lending officers can also help you understand your options and know the warning signs that keeping an eye on can make all the difference. ۔

When buying a car, do you think the dealership is capable of providing advice and guidance? This is not always possible. Have you taken the time to research and manufacture vehicles from reliable sources of information? It’s also a time to get your documents in order, such as proof of employment, insurance, or other financial information.

5. Submit.

Lastly, be prepared to submit a statement for your purchase. When it comes to buying a home, this indicates that you are a serious buyer. Typically, the stated amount is in the range of 1% to 2% of the purchase price of the home and can only be returned in certain circumstances.

To purchase a new car, a deposit may be required from the dealer, but unless you agree in writing to the price of the car, and make sure you are buying the car, pay nothing. Do Avoid deposits by going to the dealership with financial support in hand.

Tip: Make sure you consider whether the deposit is refundable before you make a purchase – especially if you think you can change your mind later.

Bottom line

Having good credit can save you hundreds or even thousands of dollars on large purchases. These basic steps can potentially lead you to the best possible interest rate. These are just some of the goal-setting shareware that you can use. Take the time now to understand your credit situation and see if there is room for improvement. Your wallet will thank you later.