Improve Your Credit Score With No Credit History

How to Improve Your Credit Score With No Credit History

If you are new to credit or “credit hidden” then finding a lender to approve your loan can be a difficult battle. Credible invisible customers do not have the required payment history reported to the credit bureau to create a credit score.

Lack of credit history does not seem to be a problem if you use cash primarily and you do not need to borrow money. But when it comes to financing a home or car, a lack of credit history or a thin credit file can be a barrier between you and a new home or set of wheels. A strong credit profile can also be important when you are renting an apartment, opening utility accounts, buying insurance, and even applying for a job.

The good news is that it is possible to build good credit from the start and starting today can put you in a better position to meet your financial goals for tomorrow.

How does Credit Scoring work?

Credit scores are not magically reflected in thin air. Instead, they are calculated using different credit scoring formulas. The FICO credit score model is one that 90% of high creditors use in credit decisions. VantageScore is another credit scoring model.

Both models use the information in your credit report to calculate your credit score. The credit report includes details of your past financial history, including:

- Number of credit accounts in your name

- Balance and payment date for these accounts

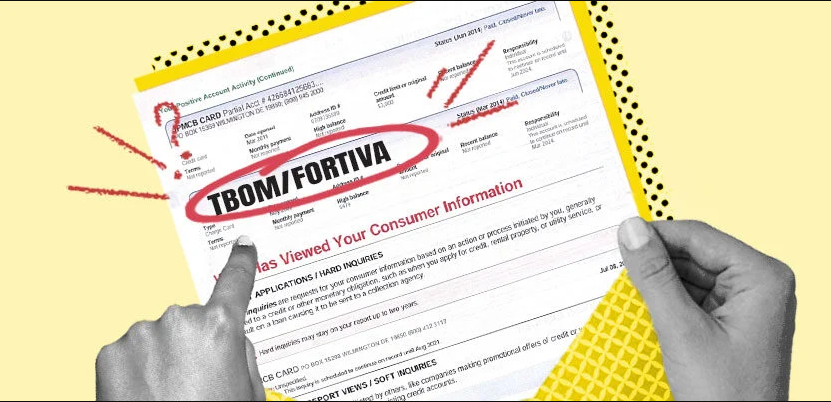

- Inquiry for new credit applications

- Public records, including judgments, bankruptcy, and foreclosure proceedings

If you do not have a credit history, you may not have much information on your credit report. This, in turn, can make it difficult to calculate the credit score. According to the Consumer Financial Protection Bureau, an estimated 45 million Americans have “hidden credit,” meaning they do not have enough credit history to score.

Where does your credit score start?

Just because you don’t have a credit history doesn’t mean your credit score starts at zero. This is because the FICO and VantageScore credit models are not so rare. Instead, with any model, your lowest possible credit score is 300. A score of 850 is the highest score you can get.

If you have no credit history at all, chances are you have no credit score. Once you start building and improving credit, your score can start at 300 and go up. So what is the effect on your credit score?

The short answer is that it depends on the credit scoring model. Since FICO scores are most commonly used by lenders, here’s how to calculate these scores:

- Payment history is based on 35% of your FICO score as of the payment date, timely payments contribute to your score and late payments hurt it.

- Credit utilization is based on 30% credit usage of your FICO score, which is the amount of your available credit limit that you are using at any given time.

- Credit Age Fifteen percent of your FICO score is based on your credit age, which is the time to use your credit.

- Credit Mix Ten percent of your FICO score is based on the type of credit you are using, such as revolving credit lines or installment loans.

- Credit Inquiries Ten percent of your FICO score is based on how often you apply for a new credit, which results in a rigorous credit check.

The fastest way to create credit

Improving your credit score can be difficult when you do not have a credit history. Even so, owning one is still beyond the reach of the average person. If you want to build credit fast, here are some of the best ways to do it.

1. Become an authorized user.

If you do not have a history of managing credit accounts, it can be difficult to get approval for loans or credit cards. Being an authorized customer on a family member or friend’s credit card is one way to create credit that does not involve applying for your own credit card. As an authorized user, you will be added to the primary cardholder’s account and you will receive your card, which you can use to make purchases (as long as the account owner agrees). The credit card account, and its payment date, will appear on your credit report, which will help you establish a credit history and score. The credit card account, and its payment date, will appear on your credit report, which will help you establish a credit history and score.

Before asking a family member or friend to add you as an authorized user, it is important to make sure that the lender reports the authorized user accounts to the credit bureau. If payments are not reported, this strategy may not be of much use to you.

Also, choose the ones whose credit history you choose to peg back to. You should only be an authorized user on an account where the primary cardholder has an outstanding payment date and a low balance.

2. Apply for a secure card.

Applying for a secure credit card can be a great way to build credit. A secured card is usually easier to qualify than a traditional unsecured card because it requires a pre-deposit that “secures” your credit line.

The deposit you need to provide varies depending on the credit card. For example, a minimum deposit of $ 200 is required for both OpenSky® Secured Visa® Credit Card and Platinum Select Mastercard® Secured Credit Card from Capital Bank. With the Capital One Platinum Secured Credit Card, you can keep a deposit starting at 49 for a credit limit of $ 200.

Credit limits on secured cards may vary but are often equal to the deposit amount. Some secured cards may charge an annual fee and other additional fees. If you are considering a secure card, shop around to see which credit card fits your needs. Experian Credit Match can help you find secured cards that might be right for you.

Once you have established a positive payment date on the secure card, you can get your deposit back and have the opportunity to upgrade to the unsecured card.

3. Apply for a store card.

Credit cards offered by stores are generally easier to qualify than other traditional unsecured credit cards. If you frequent a particular store, signing up for a store card can help you build credit when you plan to do it anyway when you make a purchase.

One thing to keep in mind: Store cards charge higher interest rates than other cards. If you decide to open a store card to make a credit, the best strategy is to pay the full balance every month. That way, you can avoid higher financial charges.

4. Report rental payments.

If you pay rent on time each month, these payments can potentially help you build credit. Like utility payments, rent payments are usually not included in your credit report. But you can ask your landlord or property management company to report your timely payments through the services.

If this is not an option, third-party rental payment services may report payments to the Credit Bureau for you. These companies may charge a monthly or annual fee, which is something to consider when signing up.