How To Remove Negative Items From Your Credit Report?

The negative details on your credit report are an unfortunate reminder of your past financial mistakes. Or, in some cases, it’s not your fault, but the business or credit bureau is responsible for the credit report errors. Either way, it’s up to you to work to remove the unsubstantiated credit report entries from your credit report.

Removing negative information will help you get a better credit score. A good credit report is also the key to getting credit card and loan approvals and good interest rates on the accounts for which you have been approved. To help pave the way for better credit, here are some strategies to remove negative credit report information from your credit report.

1. Get a free copy of your credit report.

It is important to check your credit report frequently – annually, if not more – so that you can catch any irregularities quickly.

Under federal law, you have the right to receive a free credit report once a year from the three major credit bureaus (Equifax, Experian, and TransUnion). However, due to the epidemic, all three bureaus are offering free weekly reports until April 2022.

You can apply through AnnualCreditReport.com, the only free credit report website adopted by the federal government. Be sure to request and check your reports from all three bureaus as it is not uncommon for each one to obtain different information from lenders and lenders.

In addition to your annual report, you may request additional free copies if:

- You have been denied credit, insurance, or employment based on your credit in the last 60 days.

- Sudden changes in your credit line or insurance coverage.

- You are receiving government benefits.

- You are a victim of identity fraud.

- You are unemployed and/or will apply for a job within 60 days from the date of your application.

Other Ways to Get Your Credit Report

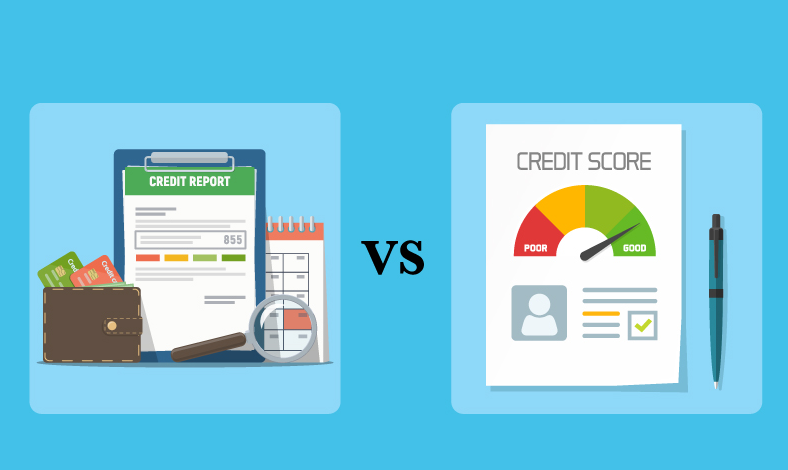

While you can get free reports from AnnualCreditReport.com, keep in mind that they do not include credit scores. In other words, if you want to monitor your FICO or Vantage scores, you will need to get your reports directly from the Bureau.

Each major bureau offers credit monitoring services that include, among other benefits, access to your report and your score.

Experian

After a 30-day free trial period, Experian’s monitoring plan costs $ 24.99 per month. Subscriptions include daily updates, monthly reports, and FICO scores. It also includes protection against identity theft, fraud resolution services, and credit monitoring, which helps you to detect any errors quickly.

Equifax

Equifax has three different service packages priced between $ 4.95 and $ 19.95 per month. Packages may include daily report updates, credit monitoring from one or all three bureaus (depending on the plan), and/or protection against identity theft.

TransUnion

The TransUnion project costs $ 24.95 per month. It monitors the credit scores of all three reporting bureaus in real-time, alerts you if someone applies for credit using your name, and offers personalized suggestions to improve your score.

Free subscriptions are available with Experian and Equifax. However, they do not include access to Competitive Bureau reports, and the information contained is updated monthly (paid subscriptions are usually updated daily).

2. File a dispute with the credit reporting agency.

Once you have your report, make sure to look at each account and see if there are any lenders you don’t know. It is also important to check whether old offensive items (seven years after the date of the original crime) are still being reported.

If you find errors in your reports, it’s time to start a dispute with the reporting bureau directly through its website or mail. It will launch an investigation by the bureau.

Keep in mind that you will have to dispute the registration with each agency to ensure that the removal process is complete across the board.

How to file a dispute online.

Each bureau – Equifax, Experian, and TransUnion – has a section dedicated to guiding users through the process of online disputes. Once you have created an account, you can file as many disputes as you need and check their status for free.

How to file a dispute letter.

You can also send a dispute letter to the bureau, detailing any errors you may have in your credit file. When writing your letter, provide documents that support your claim and be accurate about the information you are challenging. The Consumer Financial Protection Bureau (CFPB) recommends attaching a copy of your report that highlights the scope of the defect.

Depending on the controversial information, here are some documents you can provide to help with the investigation:

- Credit card or bank statements

- Copies of checks

- Letters from lenders confirm errors.

- Pay stubs.

- W-2 form

- Utility bills

- Proof of Identity (Birth Certificate, Driver’s License, Passport, e.g.)

- Police reports (in case of identity theft)

Send the letter by certified mail and request a return receipt. This will confirm that the reporting agency has received the letter, and you will receive a signature as proof. Keep a certified mail signature with copies of your letter and any attached documents.

Both the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) provide free letter templates that you can follow.

Dispute letters should be mailed to:

Equifax Information Services, LLC

P.O. Box 740256

Atlanta, GA 30374

Include this dispute form with your letter.

Experian

P.O. Box 4500

Allen, TX 75013

TransUnion Consumer Solutions

Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

Include this dispute form with your letter.

3. File a dispute directly with the lender.

You can also contact the company that first provided the information to the bureau, such as the bank or credit card issuer. Once it receives a dispute, the lender also needs to investigate and respond to all disputes that may affect your score.

Remember to include as many documents as possible to support your claim. It is also helpful to include a copy of your error report.

The address to which you should send the letter is usually listed in your report, under the negative item you want to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds out that it has made a mistake or cannot prove that the loan is actually yours, it will notify the bureau and ask it to update your file.

4. Review the outcome of the claim

Reporting agencies and lenders usually take up to 30 days to investigate a dispute. Once they have made a decision, they should notify you within five days of completing their review. The notice will notify you if the disputed item was found to be incorrect.

If the disputed information was, in fact, incorrect, the Bureau should update or delete the item. If the dispute results in a change, they should include a free copy of your file.

If the bureau or lender thinks the disputed information is not a mistake, you can file an additional claim. Review and correct your initial claims for any errors. If possible, you should include additional documentation to support your application as this may help the Bureau evaluate any data that may have been omitted for the first time.

5. Hire a credit repair service.

Disagreeing on mistakes can be a time-consuming process, especially if you have had many mistakes in your history or if you have been the victim of identity theft. Reputable credit repair companies – such as Credit Center, Lexington Law, or Sky Blue – may be viable solutions if your file is full of errors.

Credit repair services can help you handle misinformation disputes and lender negotiations. However, if you decide to hire a credit repair agency, keep in mind that there are consumer protection laws that regulate how they work and what they can do. The Credit Repair Organizations Act (CROA) sets out the following regarding credit repair services:

- It cannot provide inaccurate or misleading information about a person’s credit status and identity.

- They must provide a detailed description of the services they provide.

- They cannot charge for their services until they are completed (although most of them charge an initial work fee).

- There should be a written agreement detailing the services to be provided, the time frame in which these services will be provided, and their total cost.

- They cannot promise to remove true information from your record before the time limit set by law (seven years for most offensive items, ten years for some bankruptcy).

- You have three days to review the contract and cancel without penalty.

Before signing up with any of these companies, it is important to understand what they can and cannot do. For example, any company that promises to remove the right negative items or create a new credit identity for you is most likely involved in illegal practices or scams.

How long do negative items stay on your credit report?

It depends on what the item is, but most will fall after seven years. Yes, I said seven years. I know this is a long time coming. Chapter 7 is even longer for bankruptcy, which takes 10 years to complete.

But before you head down into despair, you should know that the effect of the negative items on your score will diminish before the end of those seven (or even 10) years until you mess up again. Do This reduction can be triggered by a minor accident such as a 30-day delay in a matter of months to a serious issue such as a charge-off for more than a year or bankruptcy.