All about 665 Credit Score

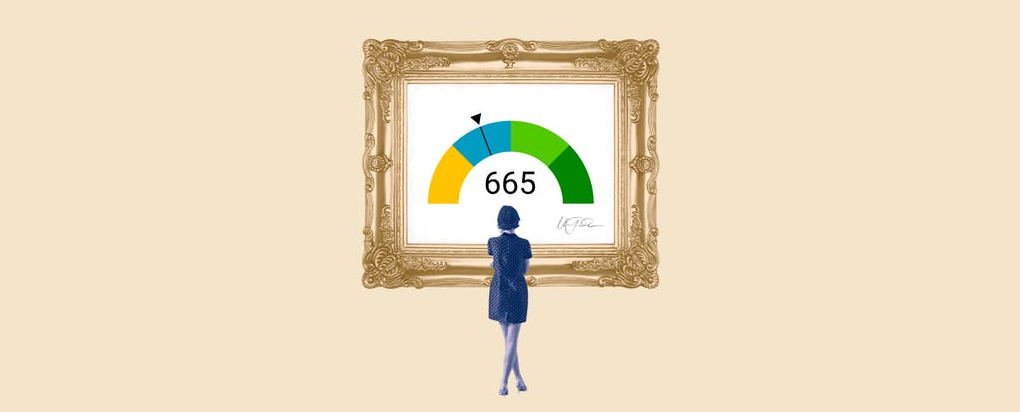

665 Credit Score – Is It Good Or Bad?

A credit score of 665 is considered “fair” credit. It’s a decent thing to do, and it should end there. Both are likely to be approved, and average APR and terms will often be offered.

665 is considered a good credit score for a car loan! The higher your credit score, the lower your chances of getting approved with lower interest rates. Most lenders recommend a credit score above 661 to get the best rate.

Since your credit score falls into the price range, you should have no problem. To make sure you get the best loan offer, shop around and collect prices from at least three different lenders.

If you want to increase your credit score to qualify for a better interest rate, try these tips:

- Don’t miss out on any payments.

- Create a credit file using the major credit bureaus to open new accounts.

- Limit how many new accounts you open.

- Keep your credit card balance low.

Is 665 a good credit score?

The 665 FICO® scores are considered “fair.” Mortgages, autos, and personal loans are hard to come by with a 665 credit score. Lenders usually do not do business with lenders who have adequate credit because it is very risky.

Good news?

Repairing your credit is one of the best ways to fix your score, and unlock the happy lifestyle that you and your family deserve.

A credit score of 665 means:

- Credit Rating: Fair

- Loan Options: Limited

- The cost of the loan: very expensive

- Best Option: Credit Repair

If so, improve your credit score?

Also, your score of 665 is very close to a good credit score of 670-739. With some work, you can reach (and even exceed) this score, which means more access to credit and loans at better interest rates.

The best way to improve your credit score is to start by checking your FICO® score. The report submitted with the score will use the details of your unique credit report so that you can suggest ways to increase your score. If you focus on the issues described in the report and adopt habits that promote good credit scores, you can see lasting improvement in scores and wider access to credit that often accompanies them.

Blue-average credit scores affect your finances:

Although 665 is close to being considered a good credit score by both major scoring models, you may still have to pay more for loans and other types of credit. This is because your lender may charge you a higher interest rate if they do not consider you a major borrower someone who is at low risk of default.

Rebuild your 665 credit score:

Credit repair companies such as Credit Glory:

- Evaluate Your Credit Report – Drag your credit report and identify all the negative, harmful items that are suppressing your 665 scores.

- Negative Dispute Items – Customize and send Conflict Letters to the Bureau requesting that these negative items be removed from your report (for good).

- Remove Harmful Items – Repair services such as Credit Glory will continue to dispute the items on your behalf unless they further damage your reputation.

Credit card options

Credit Card Options If your FICO credit score falls between a fair range of 650 to 700, then you have relatively average credit. Although financial institutions will not give you the best cards, you can still find great interest rates and terms without any hassle. Unlike people with low credit scores, you may actually be eligible for terms that result in no annual fees. And as soon as you pay regularly, you will start qualifying for better cards.

But how do you tell if your credit is good? It’s a little complicated. For starters, you don’t just have a credit score. It is very likely that you have many different credit scores that have been developed using many different credit scoring models.

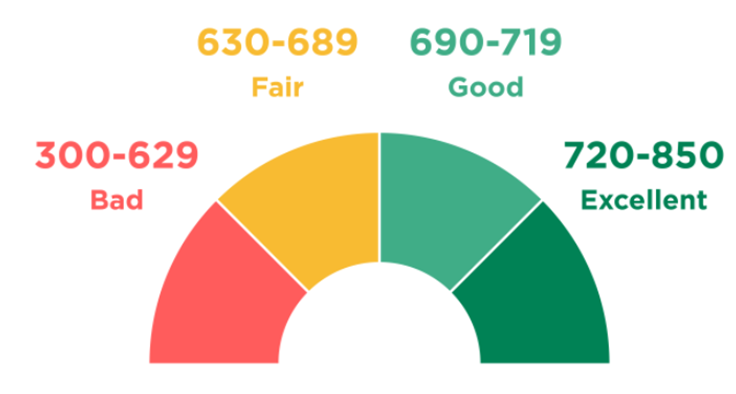

Most accredited credit scores, such as those developed by FICO and VantageScore, typically range from 300 to 850. But some scores use different ranges. Credit scoring models rely on a variety of factors to calculate your scores, generating credit report data from three major consumer credit bureaus.

What is their credit score?

A credit score measures how likely you are to repay a loan on time. The scoring model uses information from your credit report to create a credit score. Companies use a mathematical formula to build your credit score from the information in your credit report – called a scoring model.

Payment date.

Invalid accounts and late or missed payments can damage your credit score. Timely payment of your bills will help your credit score. It’s very straightforward, and it’s the single biggest impact on your credit score, which is up to 35% of your FICO® score.

Recent applications:

. When you apply for a loan or credit card, you start a process called a difficult inquiry, in which the lender asks for your credit score (and often your credit report as well). ۔ A rigorous inquiry usually has a short-term negative effect on your credit score. As long as you continue to pay on time, your credit score will usually recover quickly from the effects of severe questions. (Checking your credit is a gentle inquiry and has no effect on your credit score.) Recent credit applications can contribute up to 10% to your FICO® score.

Lower your credit atlas rates.

Your credit usage rate is a percentage of the available credit that you are using. For example, if you have a credit card with a limit of $ 1,000 and you owe $ 500, you have a credit usage rate of 50%.

In general, the lower your credit utilization rate, the better your scores. A good rule of thumb is to keep your credit usage rate below 30% – and even lower if possible. The 50% rate is an example of a high rate of credit usage that can negatively affect your credit.

You can reduce your credit utilization rate by paying off debt (and not charging more than your current credit card).

Pay on time:

Showing lenders that you can make regular payments on time is an important part of your credit profile. Focus on timely payments with your existing credit lines to create a positive payment history.

If you already have late payments or accounts on your credit reports, they will usually fall after seven years. If it has been more than seven years, or if you have paid on time and the late payment on your reports is incorrect, you can remove the late payment from your credit reports.