Credit card Rewards

Reasons to Diversify Your Credit Card Rewards

Interest rates and fees are definitely the first things to check when applying for a credit card – but the rewards and benefits are close! And so far, only 30% of credit cardholders redeem their rewards or take advantage of the points they have accumulated.

Could it be that the credit card rewards game has become more difficult to attend in recent years? Indeed.

But it is also because many credit card holders do not come up with a rewarding plan that really works for them. Here’s how to balance your credit card Prix with diversity.

How did Credit Card Rewards work?

Many credit cards receive rewards whenever they are used for eligible purchases. These rewards usually come in the form of cashback, points, or mail:

- Cashback: Cashback credit cards receive rewards that can be redeemed directly for cash, statement credits, gift cards, and other options.

- Points: You can earn general reward points or travel points. With a travel credit card, you can get generic travel points that give you a lot of flexibility in the way you redeem, or you can get airline or hotel points, which limit you to a specific travel brand. Give

- Mail: This rewards currency is usually limited to airline credit cards and select general travel credit cards. Mails may be flexible with a standard travel card, but they are more restrictive with airline loyalty programs.

Reasons to Diversify Your Credit Card Rewards

If you prefer rewards for using your credit cards for day-to-day expenses, you may be putting a price on the table if you stick to just one credit card or rewards program. Here’s how getting and using a card can help in many programs.

You will have more flexibility.

While some credit cards can be very expensive in some areas, they can get you hooked on others.

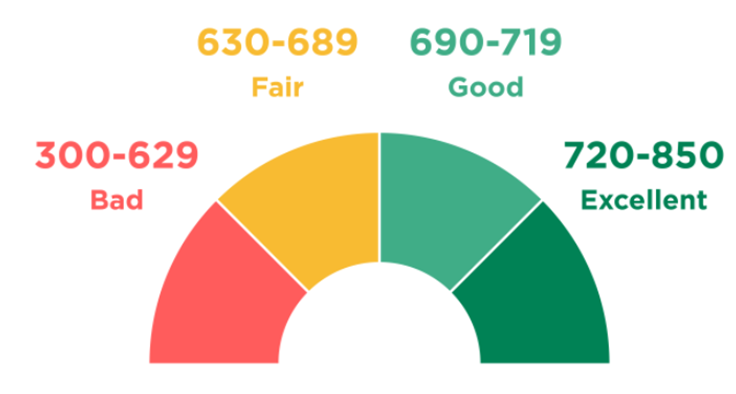

For example, Capital One VentureOne Rewards for Good Credit Card offers a lot of flexibility in redeeming your miles: you can use your rewards to book travel through Capital One, book a trip with your card and get a statement. Credit, or transfer your mail to one of Capital One’s airline or hotel partners. But if you also like the idea of withdrawing cash sometimes, the card redemption rate may be lower.

You want to have a good cashback reward credit card in your wallet to get the best of both worlds. Bank of America® Customized Cash Rewards Credit Card, for example, 3% cashback on the category of your choice and 2% cash on joint purchases of up to $ 2,500 at grocery stores and wholesale clubs, and 1% cash on all other eligible individuals. Offers back.

You will save more money.

Saving cashback or general travel points for booking a flight or hotel stay can be a great way to save money. But if you have an airline credit card or a hotel credit card, you may be able to get a higher price with this reward program.

Alternatively, you can opt for a cashback credit card that offers great rewards on gas and grocery and another that offers bonus rewards for your online purchases.

The more rewarding programs you are earning, the more opportunities you will have to take advantage of the special savings provided by each. The downside is that you will have more cards to manage, which can be a hassle.

You do not want to be frustrated if you cannot get the right pitch so invest in a good capo.

Unfortunately, it is common to underestimate the value of your rewards programs for most flight programs and hotel loyalty programs. This can happen if a program increases the number of points or miles required for specific flights or hotel stays, or even for all reservations.

If you have all your rewards with one program, you can feel the sting of the devaluation more strongly. But if you have rewards in multiple programs, a negative event with one program will not be so detrimental to your overall value.

Start with a rewarding signup offer.

With credit cards, the secret is not to put all your eggs in one basket. But, before you can take advantage of the various rewards schemes from different credit card issuers, there is one hurdle you need to overcome: signing up for the right accounts.

During the signup process, you will receive an introductory rate offer and a welcome bonus. And, of course, these offers work great in attracting potential customers to open an account. However, not all introductory presentations are created equal.

For example, you might receive a welcome offer that allows you to receive a $200 cash bonus for every $ 500 spent during the first three months. Or, if you make a 4,000 purchase within 90 days of opening your account, you can access a total of 60,000 bonus points.

No matter what the issuer offers, be sure to review both timelines and eligibility requirements and choose cards with different introductory offers.

Pro Tip – If you’re planning a vacation or a big expense, applying for a credit card and completing your purchase within the introductory offer period can help you take advantage of these one-time bonuses.

Things to keep in mind when diversifying credit card rewards

While there are many benefits to receiving rewards with multiple credit card programs, it is important to focus on responsible use of credit cards and to maintain a good balance based on your preferences and needs:

- Set up automatic payments. The more credit cards you use, the harder it will be to maintain monthly payments. Set up automatic payments on all your accounts to avoid losing payments. Also, aim to pay your bills in full to avoid interest payments.

- Consider investing time. Improving your credit card rewards can save you money, but it can also be time-consuming. Find a good balance that works for you. If you lose your chances of getting the most out of your rewards because you are defeated, you may have too many cards.

- Focus on what’s best for you. Think of the types of rewards that work best for you. While travel points and miles may be attractive, there is a turning point in learning when it comes to maximizing their value. Stay tuned for cashback if you prefer simplicity. But if you have the time and desire, pay attention to travel rewards.