Highest FICO Score

What Is the Highest Achievable FICO Score?

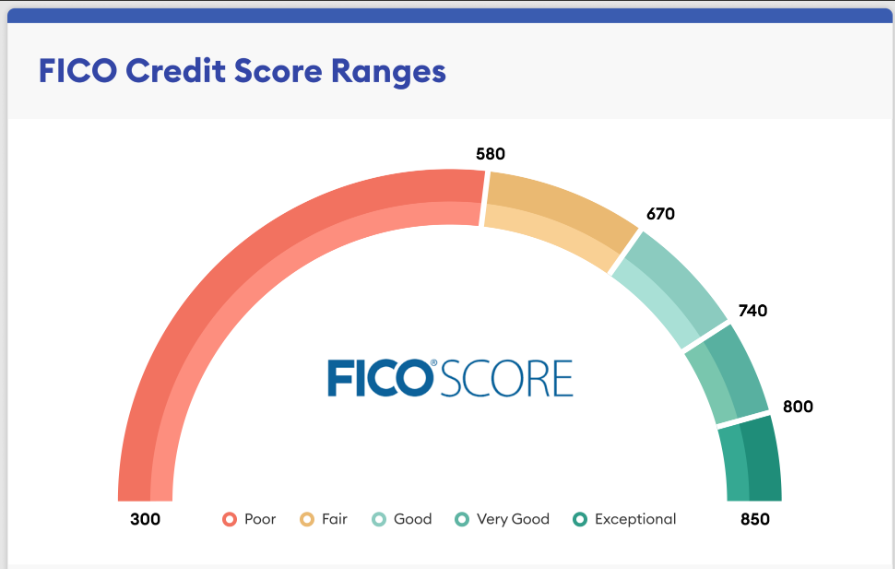

Your highest credit score is 850 on the most used scales. For the general version of FICO and VantageScore, the scale ranges from 300 to 850, and lenders generally consider the best credit above 720.

Even if you manage to get the highest credit score possible, you are unlikely to maintain it month after month. Scores fluctuate because they are a snapshot of your credit profile, which changes over time.

The widely used FICO 8 scoring model and VantageScore 3.0 are both 300-850 scales. Credit scoring company FICO says about 1% of its scores reach 850. VantageScore spokesman Jeff Richardson says less than 1% of its credit scores are accurate.

The way people get the best scores is to follow good credit habits consistently and for a long time. As you might expect, older users are more likely to score higher than younger ones.

But scores fluctuate because they are a snapshot of your credit profile. Even if you manage to get the highest credit score, you are unlikely to maintain it month after month.

What are the benefits of having a high credit score?

Thankfully, you don’t need a perfect score to qualify for some of the best rates on loans and mortgages. Scores in the 700s can qualify you for great interest rates from lenders. Get your score anywhere above 760 and you will probably be offered the best rates in the market.

Why like this? This is because banks and credit card companies pay less attention to the specific numbers on your credit reports and are more concerned about the wide range of credit scores where your scores fall.

For example, FICO score bands look like this.

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Excellent: 800+

Improving your scores from 740 to 790 will have little effect on your interest rate offers as both scores fall in the “very good” range. But raising your score from 650 to 700 could mean offering a lower interest rate.

If you want to improve your scores and get as close to 850 as possible, you need to understand why your score is going up or down.

Key Factors Affecting Your Scores: FICO vs. VantageScore

While there are differences between the VantageScore and FICO scoring models, both make it clear that some factors are more effective than others.

For both models, the payment history is the most important factor, followed by the total amount of credit owed to you (also referred to as a percentage of the credit limit used and the total balance/loan).

FICO uses percentages to indicate the importance of each factor in your credit score.

| FICO | |

| Factor | Importance |

| Payment history | 35% |

| Amounts owed | 30% |

| Length of credit history | 15% |

| New credit | 10% |

| Credit mix | 10% |

VantageScore does not assign a specific percentage of factors but indicates that some factors are more effective than others. This is how your VantageScore breaks down.

| VantageScore | |

| Factor | Importance |

| Payment history | Extremely influential |

| Age and type of credit | Highly influential |

| Percent of credit limit used | Highly influential |

| Total balances/debt | Moderately influential |

| Recent credit behavior and inquiries | Less influential |

| Available credit | Less influential |

How to make the highest possible credit score?

If you really want to fight for every possible point, we have some strategies that can help:

- Pay every bill on time, all the time. Payment history is the biggest factor in your score, so any mistake there can really push you back.

- Keep your credit balance below 10% of your credit limit. Use of Credit – The amount of your credit limit in use is another highly influential factor in your score. The less you can get it, the better.

- Have multiple credit accounts and credit cards with installment loans.

- If you have a short credit history, ask to become an authorized customer with an old, established credit card with flawless payment records and low credit usage.

- Check your credit reports to identify errors that may hinder your score. (Until April 22, 2022, you will have weekly access to free credit reports to all three credit bureaus.)

- Only apply for new credit if you really need it.

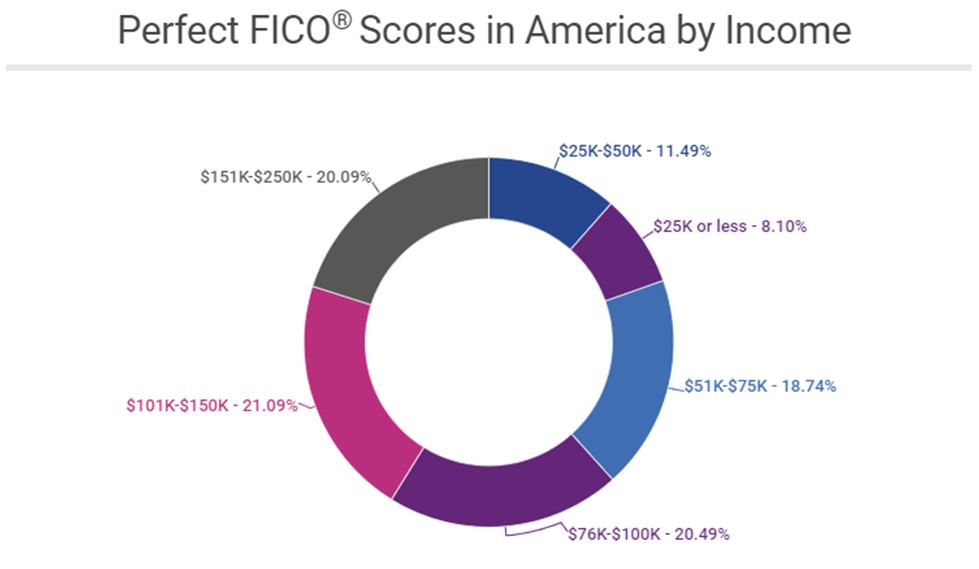

Do earnings play a role in achieving perfect FICO® scores?

Earnings are not a factor in determining your FICO® score. Although access to certain credit products may be limited by your income and financial situation, income is not a barrier when it comes to getting a full credit score.

In fact, in the fourth quarter of 2018, according to empirical data, slightly more than 38% of perfect FICO® scores were held by people with an estimated average annual income of $ 75K or less.

Obviously, having more money can help you pay off your bills, but building a healthy credit score means paying your bills on time each month and maintaining a lower credit usage, or compared to the available debt. Here’s how to put one together for use with your finances. .

States With The Highest Percentage of Perfect FICO® Scores

| Rank | State | Percentage of Perfect FICO Scores |

| 1 | Hawaii | 1.76% |

| 2 | Minnesota | 1.70% |

| 3 | Connecticut | 1.65% |

| 4 | Virginia | 1.63% |

| 5 | Maryland | 1.60% |

| 6 | New Jersey | 1.58% |

| 7 | Massachusetts | 1.52% |

| 8 | Wisconsin | 1.52% |

| 9 | Colorado | 1.45% |

| 10 | New Hampshire | 1.45% |

How To Get The Perfect Credit Score

If you want to increase your chances of getting a perfect credit score, follow these five steps. Although there is no guarantee that you will achieve perfection, at least, you can improve your score.

1. Never lose payment.

Since the due date is 35% of your credit score, it is important to pay all your bills on time. After a 30-day delay in your payment, your lenders may report it to one of the three major credit bureaus, Experian, Equifax, or Transunion. This can damage your credit score, and late payments can last up to seven years on your credit report.

To reduce your chances of missing a payment, sign up for automatic payment or use the bill management app to get reminders and see all your due dates at once.

2. Keep your credit usage rate low

The second most important credit score factor is the ratio of your credit usage to 30% of your score. The ratio of your credit usage to the amount you use vs. the amount you have available. Although it is generally recommended to keep your credit utilization ratio to less than 30%, a ratio of close to 0% will help to further increase your credit score.

3. Don’t apply for credit too often.

When you apply for a loan, a lender pulls out your credit, which leads to a rigorous credit inquiry into your report. This inquiry lasts for two years on your report. According to FICO, each new hard credit inquiry can reduce your score by up to five points. Although the effect of this type of credit check diminishes over time, it can prevent you from getting a full credit score.

4. Review your credit reports.

Credit report errors occur. If a lender reports negative information to the credit bureau that is incorrect or incomplete, it can damage your credit score. To catch and correct reporting errors, review your credit reports at least once a year.

You can view all three of your credit reports for free at AnnualCreditReport.com. Generally, you can view them for free only once a year. However, due to the CoVID-19 epidemic, you can get free weekly reports until April 20, 2022.

5. Become an authorized user.

If you do not have a long credit history, ask someone in the family who has the best credit to add you to their oldest credit cards as an authorized user. Your score may increase if the credit card issuer reports the information to the credit bureau for authorized customers. The downside, however, is that your score may be lower if the primary cardholder misses the payment and this is reported in your credit report.