5 Ways to Consolidate Credit Card Debt

Stabilizing / consolidating credit card debt can help ease and reduce your monthly payments as you work to get out of debt.

Credit card debt consolidation is when you combine multiple credit card balances into one monthly payment, ideally at a lower interest rate than what you are currently paying.

But consolidating your debt takes time, and in many ways requires an application process to see if you have been approved in advance, which usually leads to a rigorous credit inquiry. This may result in a decrease of some points in your credit score.

What is Credit Card Consolidation?

Credit card consolidation is a strategy in which multiple credit card balances accumulate in one balance. This makes it easy to track because there is only one monthly payment and the due date. This consolidation strategy often comes with a lower APR which will save on the total interest paid, giving you the opportunity to pay off the balance faster.

What is a credit card debt consolidation loan?

A credit card consolidation loan is when a new loan is taken out to pay off your existing debts. For simplicity, suppose you have three credit cards, each with a balance of $ 1,000. The Consolidation Loan is borrowing $ 3,000, repaying your three $ 1,000 balance credit cards, and is now the only 3,000 single loan.

How Does Credit Card Consolidation Work?

The process of stabilizing a credit card is usually straightforward. With a loan officer, credit counselor, or working on your own, you collect all the debts you want to settle in one payment. From there, you have a plan or loan set up to make monthly payments in one place, which will make it easier to remember your due date, and hopefully have a lower APR for overall payments.

With that in mind, let’s cover some sustainability strategies that may be accessible to you. Either way, it’s not a complete list but it may offer some ideas that you may not have considered before.

Top 5 ways:

1. Balance transfer card

Pros:

0% introductory APR period.

Cons:

- The best credit is needed to qualify.

- A balance transfer fee is usually charged.

- High APR starts after the initial period.

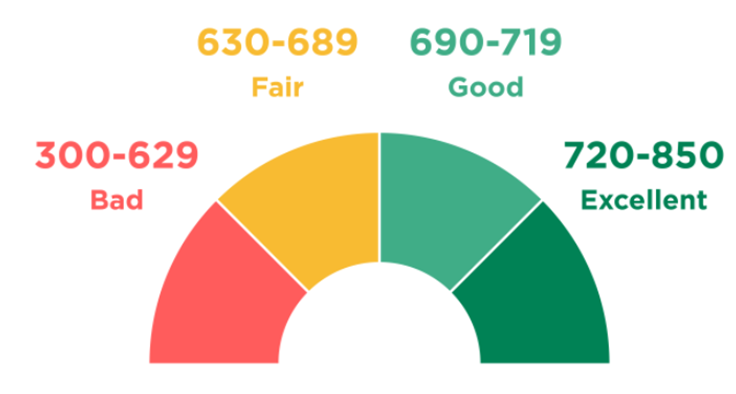

Also called credit card refinancing, this option transfers credit card debt to a balance transfer credit card that charges no interest for a promotional period, usually 12 to 18 months. To qualify for most balance transfer cards you will need the best credit (690 or more on the FICO scale).

A good balance transfer card will not charge an annual fee, but many issuers charge a one-time balance transfer fee of 3% to 5% of the amount transferred. Before choosing a card, calculate whether the interest you save over time will reduce the cost of the fee.

Plan to repay your balance in full before the 0% intro APR expires. Any balance remaining after that time will have a regular credit card interest rate.

2. Credit card consolidation loans

Pros:

- A fixed interest rate means your monthly payments will not change.

- Fewer APRs for better credit.

- Direct payments to lenders are offered by some lenders.

Cons:

- It is difficult to get low rates with bad credit.

- Some loans have an initial fee.

- Credit unions require members to apply.

You can use unsecured personal loans from credit unions, banks, or online lenders to secure credit cards or other types of loans. Ideally, a loan will give you a lower APR on your loan.

Credit unions are nonprofit lenders that can offer their members more flexible loan terms and lower rates than online lenders, especially for borrowers with fair or bad credit of 689 or less (FICO scale). Federal credit unions charge a maximum APR of 18%.

Bank loans provide competitive APRs for good borrowers, and the benefits for existing bank customers can include large loan amounts and discounts on rates.

Most online lenders allow you to pre-qualify for a credit card consolidation loan without affecting your credit score, although this feature is less common in banks and credit unions. Pre-qualifying gives you a preview of the rate, loan amount, and term you can get after you have formally applied.

3. Home equity loan or line of credit

Pros:

- Lower interest rates than personal loans.

- Good credit may not be required to qualify.

- Longer payments keep payments low.

Cons:

- To be eligible, you need equity in your home, and a home appraisal is usually required.

- Safe with your home, which you may lose by default.

If you own a home, you can take out a loan or line of credit on equity in your home and use it to pay off your credit cards or other debts.

A home equity loan is a lump-sum loan with a fixed interest rate, while a line of credit works like a credit card with a variable interest rate.

A HELOC often requires payment of interest during the lottery period, which is usually the first 10 years. This means that you will need to reduce the principal and pay more than the minimum due to the reduction in your total debt during this time.

Because loans are secured through your home, you are more likely to get a lower rate than what you would get on a personal loan or balance transfer credit card. However, you can lose your home if you do not keep your payments.

4. 401 (k) Debit

Pros:

- Lower interest rates on unsecured loans.

- It does not affect your credit score.

Cons:

- This can reduce your retirement fund.

- Heavy fines and fees if you can’t refund.

- If you lose or quit your job, you may have to repay your loan sooner.

If you have a retirement account like the 401 (k) plan arranged by the employer, it is not advisable to take a loan from it, as it can have a significant impact on your retirement.

Only consider rejecting balance transfer cards and other types of loans.

One advantage is that the loan will not appear on your credit report, so it will not affect your score. But the disadvantages are significant: if you can’t repay, you’ll be liable for heavy fines plus unpaid balances, and you’ll be left with no more debt.

In addition, 401 (k) loans are generally due within five years, unless you lose or leave your job. Then they owe the next year’s tax day.

5. Debt management plan

Pros:

- Fixed monthly payment.

- It can cut your interest rate by half.

- Doesn’t hurt your credit score.

Cons:

- Startup fees and monthly fees are common.

- It can take three to five years to pay off your debt.

Debt management plans incorporate many low-interest loans into one monthly payment. It works best for those who are struggling to pay off their credit card debt but are not eligible for other options due to their low credit score.

Unlike some credit card stabilization options, debt management plans do not affect your credit score. If your debt is more than 40% of your income and cannot be repaid within five years, bankruptcy may be a better option.