All about Credit Rating

What Is a Credit Rating?

A credit rating is a measure of a person’s or a business’s ability to pay its financial obligations based on its income and past payment dates. Commonly expressed as a credit score, banks and lenders use credit ratings as a factor in determining whether to lend money. Individuals receive credit ratings from one of the three major credit reporting agencies in the United States: TransUnion, Experian, and Equifax.

Define Credit Rating?

Credit ratings can determine if you are eligible for financing. Your credit rating is a measure of your past repayment history on loans, including credit cards and personal loans. You can return them.

If you maintain a high credit rating, banks and lenders are more likely to approve your financing. A poor credit rating may represent a failure to repay the loan and limit your financial options.

Credit ratings and credit scores often work against each other. For example, most businesses receive credit ratings from agencies such as Standard & Poor’s as letter grades (such as Triple-A, Double-A, or A), while you get a credit rating. Gets a rating, called a FICO score.

The most common factors that affect your credit score are the length of your credit history, past payment history, and the use of your credit. The three credit reporting agencies collect that information and create your credit profile, which will determine your overall credit rating and score.

Credit rating types

Different credit agency agencies use the same alphabetical symbols to determine credit ratings. However, these ratings are also grouped into two types of grades, ‘investment grade’ and/or ‘speculative grade’.

- Investment Level: This rating indicates the fact that the investment made is solid, and the borrower will probably meet the repayment conditions. Thus, their value is often lower.

- Speculative rating: This rating indicates that investments are at high risk, and often have high-interest rates.

Is There a Difference Between Credit Rating and Credit Score?

Sometimes, the terms credit score and credit rating are used interchangeably, but they are not the same thing.

As mentioned above, credit ratings are used to determine the reputation of a business or company rather than individuals. This basically means that their payments are likely to default. Classification is usually represented as a series of alphabet symbols and is calculated using corporate financial instruments.

However, a credit score is a number that is usually between 300 and 900, given to individuals for rating their credentials. It is calculated on the basis of a person’s credit information report by the credit bureau, and it plays a role in determining whether they are approved for loans and credit cards.

What is the significance of credit rating?

Since a credit rating is a measure of a borrower’s creditworthiness, a high credit rating indicates that the company or institution is more likely to repay the loan. On the other hand, lower credit ratings may mean that they are more likely to become defaulters. This can make it difficult for them to borrow money, as lenders will consider them high-risk borrowers.

However, there are other ways for which credit rating is important:

For lenders

- Lenders and investors can make better and more accurate investment decisions based on the risk of the institution that is borrowing the money.

- Once lenders know the credit ratings of potential lenders, they can be assured that their money will be repaid on time, with the right amount of interest.

For borrowers

- When companies have higher credit ratings, they will be seen as less risky and therefore loan applications are more easily accepted.

- Lenders such as banks and financial institutions will also offer low-interest rate loans to institutions with higher credit ratings.

Thus, having a high credit rating can help a company grow and grow, while also reducing the cost of borrowing. And, for lenders, these ratings can help them gain more detailed financial information and encourage better accounting standards.

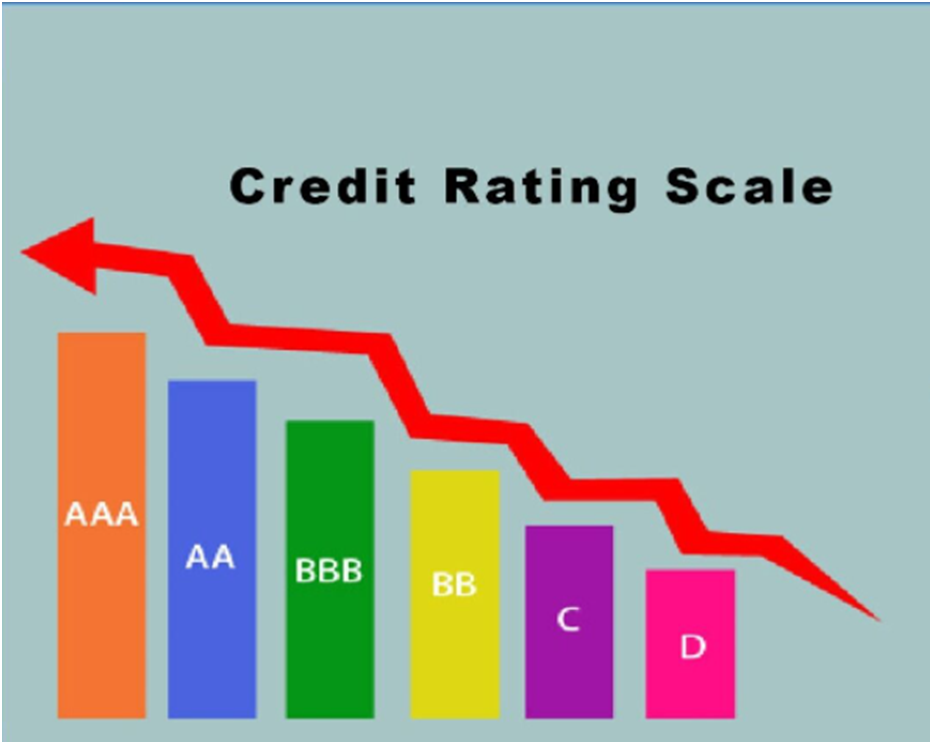

What are the different credit rating scales?

Various credit rating agencies offer similar ratings (from AAA-D) to represent the company’s reputation and the risk it poses to investors for long-term and medium-term debt instruments.

| Rating Scale | Symbol |

| Lowest credit risk / Excellent credit rating | AAA |

| Very low credit risk / Very good credit rating | AA |

| Low credit risk / Good credit rating | A |

| Moderate credit risk / Average credit rating | BBB |

| High credit risk / Low credit rating | B |

| Very high credit risk / Poor credit rating | C |

| Defaulted | D |

What are the Factors that affect Credit Rating?

There are a number of factors that can affect the credit ratings of a company, including:

The company’s financial history:

- Lending and borrowing history

- Past debt

- Payment history

- Financial statements

- Level and type of current debt

The company’s future economic potential:

- Ability to repay the debt

- Projected profits

- Current performance

A credit rating is a measure of the creditworthiness of an organization that wants to make money. This includes corporations, NGOs, provincial authorities, or governments. These ratings are assigned by certified credit rating agencies that review the company’s financial history and ability to repay borrowed loans.

Because it is used by lenders and investors to decide whether to approve loans or to engage in business ventures, it is important to have a good credit rating because it allows the company to raise money, and interest rates. Can help reduce, and encourage better accounting standards.

Example of a credit rating

Your credit rating or score is never a stable number, and this may change based on new information that financial institutions send to reporting agencies. If you miss a payment or apply for a new line of credit, that information is forwarded to credit reporting agencies. If you have a high credit rating, a small payment can lower your credit score.