All about Superlativee RM

Superlative RM is a third party debt collection agency based in Elk Grove, California. FCS is not accredited by the Better Business Bureau. To be recognized by the Better Business Bureau, a company must demonstrate trust, honesty, transparency, accountability and integrity. The Better Business Bureau has received consumer complaints alleging that Superlative RM is engaged in undesirable methods of debt recovery, including:

- False discussion of consumer debt with a third party; And

- Harassing customers with repeated calls.

One user reported receiving a phone call from Superlative RM. The agent was looking for the user’s brother. The user advised the representative that the user does not have contact with his brother and does not have any contact information for him. After this conversation, Superlative RM started calling the user four (4) times a day. Superlative RM responded to consumer complaints with the Better Business Bureau and agreed to cut off further communication with consumers.

The Fair Debt Collection Practices Act (FDCPA) and the Rosenthal Fair Debt Collection Practices Act (RFDCPA) regulate the interaction of debt collectors and lenders with third parties. The debt collector is only allowed to contact a third party when the debt collector is reasonably confident that the person will have information about the customer’s location or telephone number. More importantly, debt collectors are only allowed to contact a third party once. Repeated third party phone calls are a form of harassment and are protected by third party FDCPA and RDCPA.

Lenders and debt collectors must be held accountable for these unethical and illegal practices. If you are being harassed or you are being subjected to any of these, fraudulent, or disgusting debt recovery methods, it is time to hold Superlative RM accountable.

Who is Superlative RM?

Superlative RM Comstock Holdings or Superlative Receivables Management is a debt collection agency based in Elk Grove, California. They specialize in the following verticals:

- Automotive

- credit card

- Commercial

- Fantastic

- Health care

- Retail card

You can see the above RM as the account deposited in your credit report. This can happen when you forget to pay the bill.

How do I remove Superlative RM from my credit report?

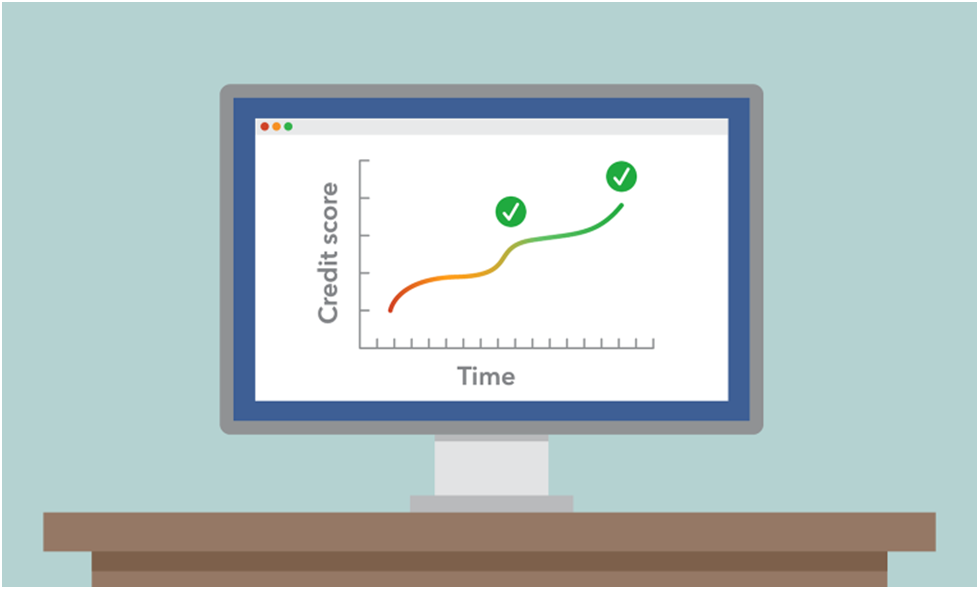

Aggregates can damage your credit score and can last up to seven years on your credit report whether you pay it or not. Unfortunately, paying a deposit can also lower your credit score.

However, it is possible to delete a collection account from your credit history within seven years.

(Debt collectors prefer that we do not tell you, but this is something you should know.)

Lexington Law is a professional credit repair company that helps people fix their credit.

In addition to collecting, Lexington Law can help you remove other incorrect information from your credit report, such as inquiries, late payments, charge-offs, foreclosures, repossessions, decisions, lenses, and bankruptcy.

Is Superlative RM Comstock Holdings a scam?

They are legitimate. According to the Better Business Bureau (BBB), Superlative RM Comstock Holdings is a consolidation agency that uses an alternative business name, Superlative Bis. BBB created a profile page for SRM in 2006. Buzzfile reveals that SRM was founded in 2008 and provides a secondary web address for this collection agency at www.resolvemyaccount.com.

According to its website, SRM is “an industry leader with financial strength, proven efficient operating strategies, and a decent work environment.” SRM describes itself as a “strategic partner, who can handle customer relationship and accounts receivable management efficiently.”

Should I contact Superlative RM or pay?

There is nothing better than talking to a collection agency on the phone. And paying on the collection account will reset the clock. So instead of helping your credit, it can make it worse. Of course, there are times when it’s better to just pay the depositor’s account, especially if it’s new and you believe it’s legitimate.

The best way to handle this is to work with a professional credit repair service. They have removed millions of negative items from companies like Superlative RM for millions of clients across the country.

Will Superlative RM sue me or garner my wages?

In an attempt to collect the debt, the receiving agency may resort to litigation. However, if you work with a law firm like Lexington Law, you don’t have to worry. They will help you to dispute the deposit account and possibly remove it from your credit report. It is also possible that you will never hear or deal with Superlative RM.

Call Lexington Law to find out how they can help you avoid litigation and remove negative items from your credit report that will significantly improve your credit score.

Superlative RM complaints

Most collection agencies have several complaints against them in the Consumer Financial Protection Bureau (CFPB) and the Better Business Bureau (BBB). Most consumer complaints are about misreporting, harassment, or failure to verify a loan. If the debt collector is harassing you, you may want to consider filing a complaint.

You have many consumer rights under the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA). Lexington Law knows you have rights, and so does Superlative RM.

How Collection Affect Your Credit

Payments missed over several months will affect your credit score. With an account credited to your credit report, this will further reduce your eligibility for new credit.

Debt collectors often buy and sell loans from each other, so it can show multiple aggregates on your credit reports for a single account.

When this happens, if you do not dispute the accounts with the credit bureau and remove them all, they will damage your credit score.

Can I sue Superlative RM for harassment?

Yes. If you want to enforce your rights or get paid for violations, you have to sue. Federal law allows individuals like you to obtain financial damages in court. For example, the FDCPA allows consumers who have been violated to recover attorney fees and court costs in addition to damages of up to $ 1,000.

Stop harassing debt collectors.

You may have a case, if

- You are receiving multiple calls each week from third party collection agencies.

- You are receiving early morning or late night calls from debt collectors.

- You are receiving calls from a work debt collection agency.

- Debt collectors are inviting your family, friends, neighbors, or co-workers.

- Collectors are threatening to torture, sue, or arrest you.

- A debt collector tries to collect more than you owe.

- You are being threatened with negative credit reporting.

- A debt collector tries to scare you.

- You are facing criminal charges.

- Use of obscene language while trying to collect

- Automatic robot calls are being made to your phone in an attempt to collect.