Banks vs. Credit Unions

Banks vs. Credit Unions: What’s the Difference?

When you are looking for a new checking or savings account, loan, or line of credit, you have more choices than the many local and national banks competing for your business. The most overlooked option for this type of product is the credit union, which offers many similar financial products and services that you can get at the bank.

But what exactly is a credit union, and how is it different from a traditional bank? Although both banks and credit unions have similar offerings, there are some important differences between the two types of institutions.

Understanding the difference between banks and credit unions can help you make the best decisions for yourself and your family. Here’s what you need to know about how banks compare to credit unions, so you can find the best home for your money.

What’s the Difference Between Banks and Credit Unions?

| Banks | Credit Unions |

| Owned by shareholders & investors | Owned by member customers |

| Serve the public | Serve members only |

| Offer topline products & apps | May not offer all types of loans |

| Payless interest on deposits | Pay more interest on deposits |

| Charge higher rates on loans | Charge more favorable rates on loans |

Bank vs. Credit Union Ownership

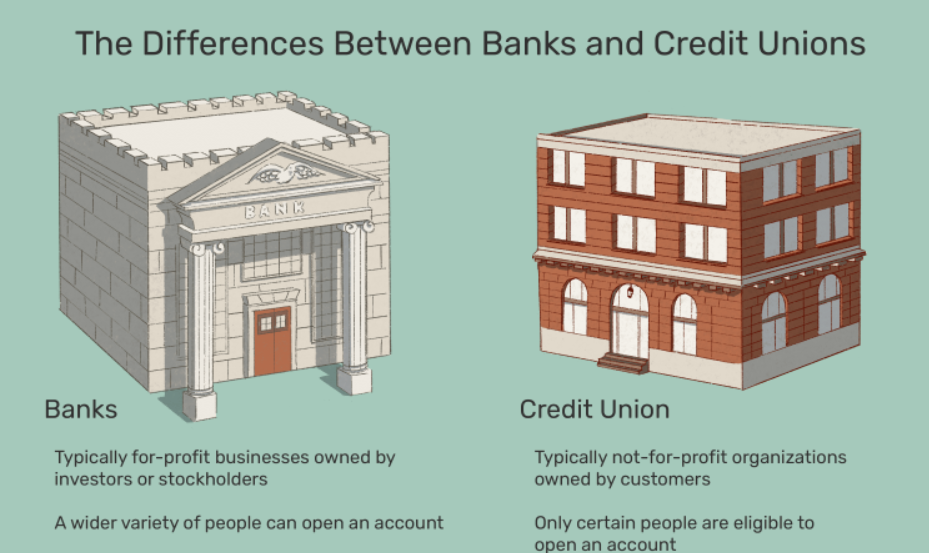

The main difference between banks and credit unions is ownership. Credit unions are non-profit organizations. They are owned and controlled by their customers, who are called “members”. The main purpose of credit unions is to promote the financial well-being of their members and to return profits to them.

Banks are for-profit organizations owned and operated by shareholders. Depending on the bank, these investors could be thousands of anonymous stockholders or just a few large investors. The main objective of banks is to maximize profits for their shareholders.

Bank vs. Credit Union Eligibility

Banks are open to the public. Regional banks that operate within a specific area may limit some or all of their banking products to the people of that area. National banks generally extend individual accounts to any legal resident 18 years of age or older.

Credit unions need to limit their customer base to a group of people who share a common bond called a “field of membership”. Meeting the need is relatively easy. Depending on where you work, you may be eligible to join a credit union. , Where you live, or because of your membership in an organization, such as a school or place of worship. You may also be eligible because a family member is eligible.

Bank vs. Credit Union Products

The choice of bank or credit union will not limit the products available to most consumers and consumers who want to handle personal and small business finances. The basic offerings in both types of financial institutions are practically identical.

Most banks and credit unions offer:

- Checking accounts

- Savings accounts

- Money Market Accounts

- Certificate of Deposit (CD)

- Business bank accounts

- Home loan (including purchase loan and refinancing)

- Auto loans for new and used vehicles (including motorcycle and RV loans)

- Land and construction loans.

But the bank is more likely to offer special products, such as student loans or trustee services. A small credit union may not be able to meet your needs in these areas, although it never hurts to ask. Some small enterprises have partnerships with service providers that allow them to deliver these products to their customers.

Both banks and credit unions also offer online banking services and mobile apps for account management, although the bank may offer more advanced features. But both allow you to view your accounts, deposit money from your mobile device, transfer money between accounts and pay bills.

How banks and credit unions are alike?

If you are a general customer who wants to establish a banking relationship, chances are you will find what you need in a bank or credit union.

Here are some products and services you can find in both credit unions and banks.

- Checking and savings accounts

- Money Market Accounts

- Home loan

- Auto loan

- Small business loans

- credit card

Both banks and credit unions generally offer direct deposit, mobile banking, ATM, and overdraft protection. And while some large banks may have large ATM networks, some credit unions reimburse fees collected from ATMs outside the credit union network, allowing you to withdraw money for free at more locations.

Most credit unions and banks offer similar protections for deposits, with up to $ 250,000 insured against loss of funds deposited. Insurance is provided by banks for the Federal Deposit Insurance Corporation and for credit unions through the National Credit Union Administration. To make sure your company is federally insured, look for an official NCUSIF- or FDIC-insured sign. Or use the FDIC’s BankFind tool or the National Credit Union Administration’s Credit Union Locator.

Why choose a bank?

While the fact that credit unions are non-profit and can focus on members can sound like a clear winner against banks, there are a number of reasons why consumers may choose banks.

To get started, banks are open to customers interested in a product or account, provided the customer’s banking history is not bad. Credit unions are open to members only, and you may not be eligible for membership if you or someone in your household does not belong to the community that provides services through the credit union. This makes banks an easy choice for many customers who have no special affiliation with the credit union services community, although some credit unions allow you to become a member by paying a nominal membership fee.

Banks generally have more branches and ATMs available than credit unions. This additional feature makes it easier to access your money from any bank, as you can find branches and ATMs in your city, state, and even across the country. That said, credit unions often partner with others to provide additional branches across the country and provide free access to ATMs.

Banks usually outperform credit unions when it comes to financial technology. As for-profit entities, banks have the money to invest in things like mobile banking apps, which have become more important than ever in the 24/7 world. While many credit unions have worked to accelerate their game when it comes to services such as mobile check deposits and banking apps, they do not tend to work at the forefront of technology, as many banks do.

Finally, while both banks and credit unions offer a wide range of products of the same type, banks offer potentially much wider options. For example, not all credit unions offer commercial loans, although such loans are a standard part of a bank’s offer. Credit cards offered by banks are also likely to offer greater benefits to cardholders than credit union cards, which tend to be a bit more.

Why Choose a Credit Union?

As a cooperative financial institution, a credit union puts its members first. This means that credit unions are known for their excellent customer service. When a member visits a credit union branch, they can usually expect a personal focus and a commitment to meet their needs. In addition, your membership in a credit union is good for life, even if you leave the organization or community that provides services through the credit union.

Credit unions also provide essential financial education to their members as part of their services. In addition to the types of online articles and tools you can find on many banking websites, many credit unions also offer in-person seminars on important financial topics, such as credit card management, and identity theft. Stop, buy a home, and plan for retirement. Or state planning.

The biggest benefit of credit unions is financial. A report by the National Association of Credit Unions (CUNA) found that the average annual financial gain per member of a credit union in 2018 was $ 85. For households, the benefit was $ 178.

So how does an average credit union member see such benefits? To begin with, any profit the credit union sees will be distributed to its members in one of two ways: either by earning interest on their deposit accounts or by receiving dividend checks from time to time.

In addition, the fact that credit unions are unprofitable also means that they often do not have a minimum balance requirement, require fewer deposits to open accounts, and overdrafts, non- There are plenty of funds and ATM fees. Finally, you are more likely to get lower interest rates on loans from credit unions than from banks.

BANKS

| Pros | Cons |

| More products offered | |

| Likely more branches and ATMs * | Higher interest rates on loans |

| Financial technology | May offer lower APYs on savings vehicles |

| Convenience | More and higher fees |

CREDIT UNIONS

| Pros | Cons |

| May offer lower interest rates on loans | May have fewer branches and ATMs * |

| Higher APYs on savings vehicles | Less access to financial technology |

| Fewer and lower fees | Fewer products offered |

| Excellent customer service and financial education | Eligibility requirements to become a member |

| Accounts NCUA-insured up to $250,000 |